Our Senior Insights Analyst, Tobias Lagergren, has combed through the data to uncover the trends that defined private aviation in 2024. From evolving aircraft preferences to regional market shifts, these insights paint a picture of an industry that continues to adapt and thrive in changing conditions.

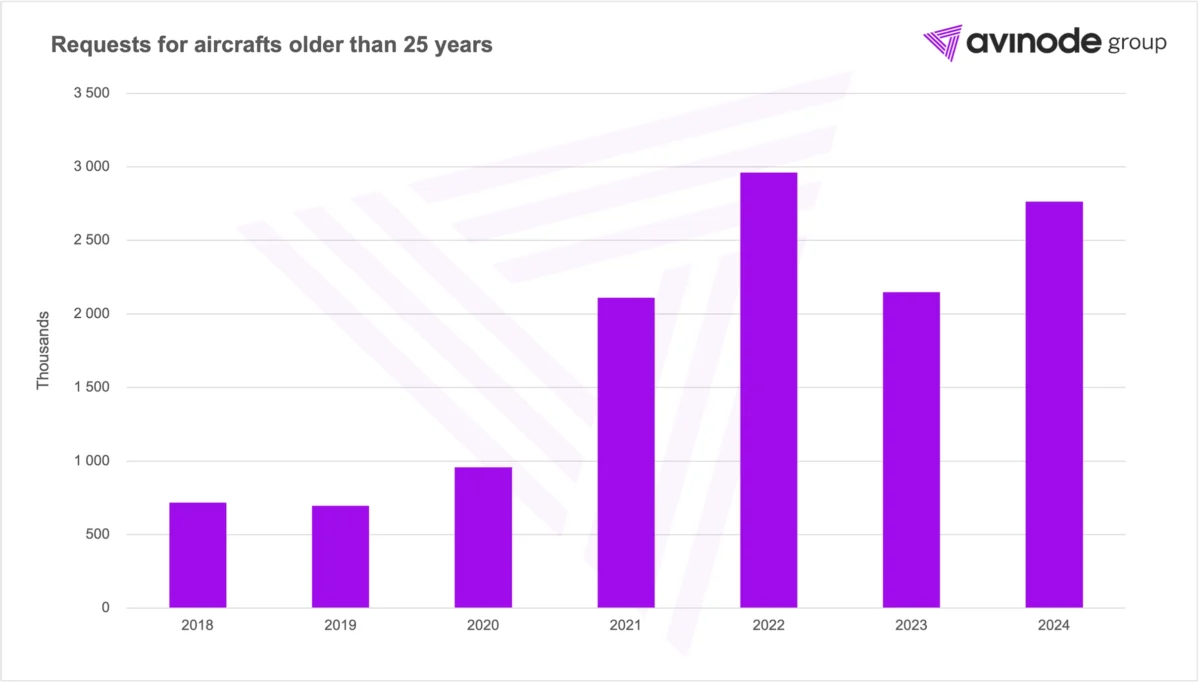

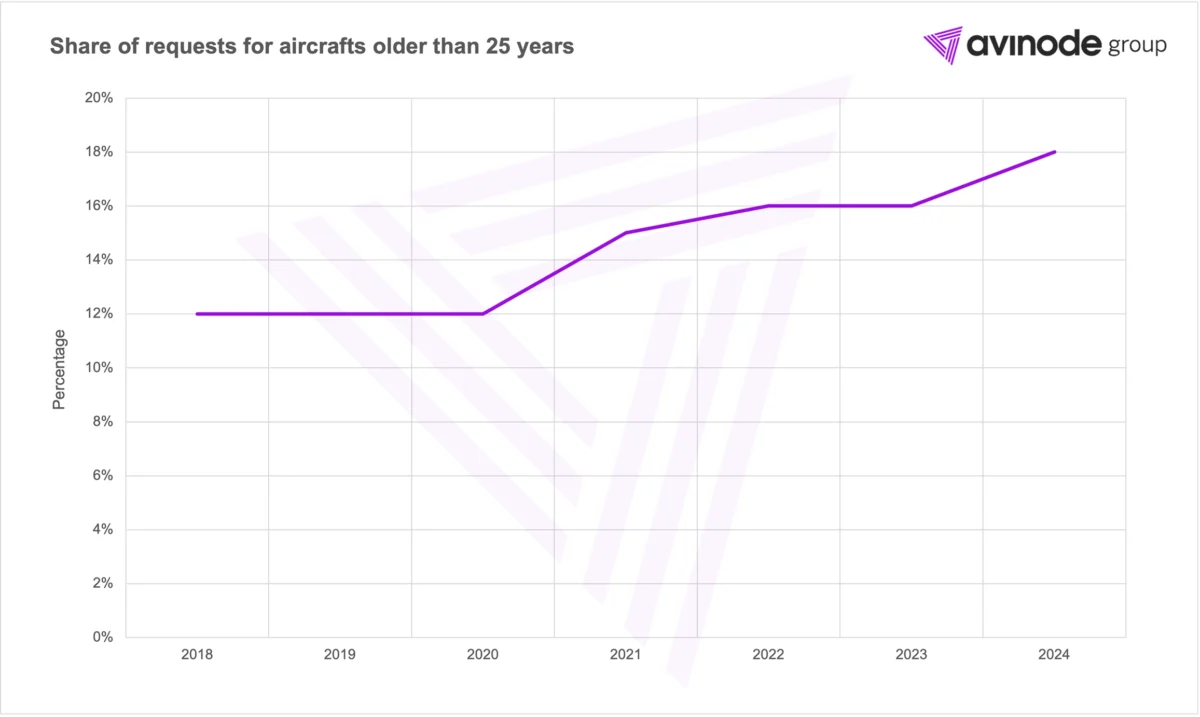

Aircraft lifespan is still growing

One of the trends we’ve observed is the continued evolution of aircraft utilization. Our data shows that aircraft aged 25 years or older receive more requests than ever, though slightly below the peak in 2022. This continues a trend we identified last year when we first noted the significant increase in older aircraft utilization. While we questioned whether this might be driven by more price-conscious clients entering the market post-COVID, the continuation of this trend in 2024, despite stable rates, suggests other factors at play. These can be improved maintenance capabilities, the ongoing supply chain challenges in new aircraft delivery, and operators’ ability to maintain older aircraft to meet modern standards.

The return to predictability

One of the most significant indicators of market normalization is the return to pre-pandemic lead times. In 2024, average lead times stabilized at around 25 days, maintaining the same level we observed in 2023, which marked a significant return to pre-pandemic patterns. European markets show slightly longer lead times than their US counterparts, reflecting different regional planning behaviors and market dynamics.

New pricing dynamics

Charter rates have maintained their strength throughout 2024, reaching an all-time high in Europe and near-peak levels in the US. Both markets experienced a price dip at the beginning of the year before recovering toward year-end. The US market has seen notable pricing and fleet composition developments. While prices have remained elevated since the pandemic, the most significant change has been in the mix of aircraft available. Avinode Demand data shows a 25% increase in international heavy aircraft since last year’s Christmas peak. These shifts in the US market add another layer to the broader regional trends, where 2023 saw Europe experiencing typical summer increases while US prices followed a weaker trajectory until November when they began their current upward trend.

Shifting regional patterns

Regional demand patterns tracked through Avinode reveal stability in major aviation corridors and emerging trends across different regions. The US market stands out, showing consistent year-over-year growth since mid-2023, a trend industry analysts have dubbed the “Trump bump.” This could be the reason for the rising pricing index seen after the presidential election in November. This momentum and positive industry sentiment point to continued growth into 2025.

European activity has remained resilient throughout 2024, even with the continued absence of Russian market demand. Meanwhile, the Middle East has transformed into an increasingly dynamic market, with Saudi Arabia’s ambitious plans to become the region’s primary business aviation hub challenging the UAE’s long-standing dominance.

The Asia-Pacific landscape tells a more nuanced story, with activity patterns reflecting broader geopolitical dynamics, especially concerning China. Commercial aviation networks in the region continue to operate at less than 50% of pre-pandemic capacity, while Oceania and CIS regions have seen notable departure declines. Yet despite these regional variations, the business aviation sector demonstrates good health overall, with activity levels climbing across all global regions compared to previous years.

Distance metrics and global reach

In 2024, the total distance of requested trips through Avinode reached 2,858 million nautical miles, equivalent to circling the globe more than 132,000 times. During the pandemic, average trip distances increased as travelers opted for longer flights. In the years since these distances have gradually decreased, and by 2024, the average trip distance has returned to pre-pandemic levels, reflecting a normalization of travel patterns.

Looking ahead

Several clear trends have defined business aviation in 2024: the continued utilization of older aircraft, stabilized lead times around 25 days, record-high charter rates in Europe, and shifting regional patterns with particular strength in the US market and emerging dynamics in the Middle East. As we look toward 2025, key questions arise: Will these pricing dynamics hold? Can the Middle East’s ambitious aviation hub plans reshape regional traffic patterns? And how will the industry’s growing comfort with older aircraft impact fleet decisions? Our CEO predicted 2024 would be the year AI would make its mark on our industry, and while that hasn’t happened, perhaps 2025 will be the year AI truly takes flight in private aviation.