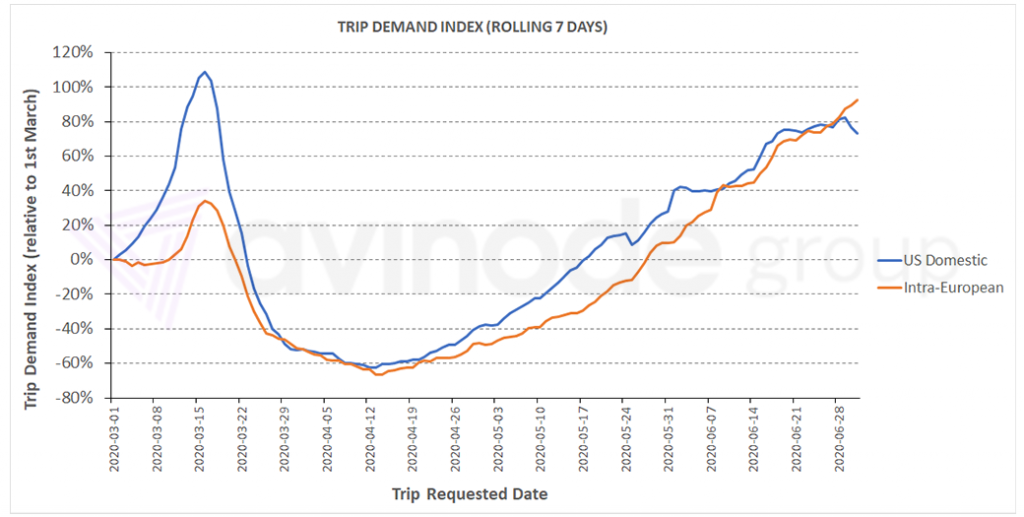

Trip demand index

The chart below is a rolling 7-day index of demand normalised to 1st March, for trips requested through the Avinode marketplace. New restrictions have seen demand for US domestic (blue) charter flatten in the last week or so. Demand for intra-European flights (red) continues to steadily increase.

US domestic demand significantly higher

Since the start of June, demand for US domestic travel through Avinode has been significantly higher than the same period last year, supporting reports of a surge of customers new to charter. Regionally, travel on the East Coast has led the way, but demand is now more equally spread across the country. The slowest segment of the market to recover has been for travel within the Northeast, but it is trending in the right direction. Within the Northeast, demand for travel next week (6th to 12th July) is down 33% compared to the same stage of the booking cycle last year, compared to down 42% for last week (22nd to 28th June).

“Demand for US domestic travel through Avinode has been significantly higher than the same period last year.”

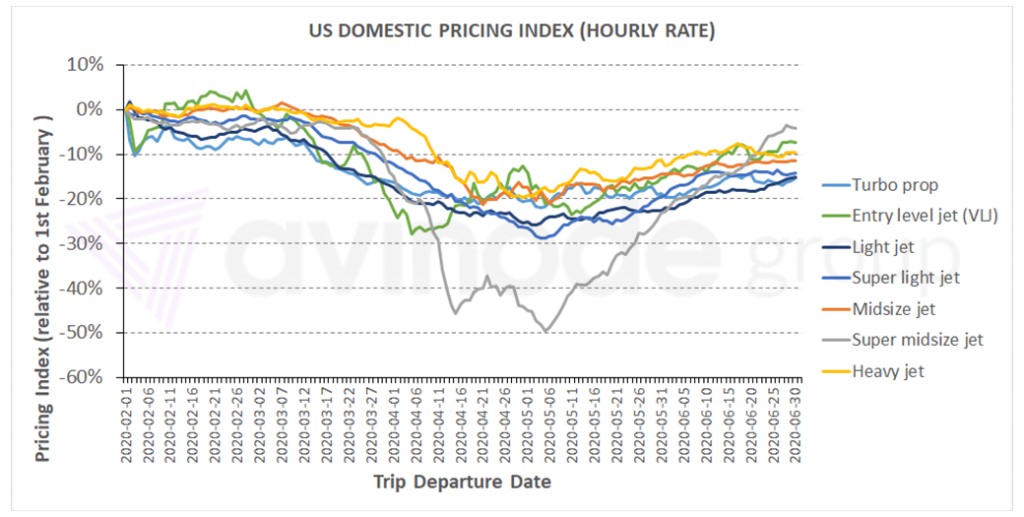

Changes in charter rates have reflected the shifting demand environment. The below is a price index based on quotes in the Avinode marketplace, normalised to 1st February. Most categories saw a decline to around the -20% level, followed by a gradual improvement from early-May. The category that saw the biggest price changes was Super Midsize. These rates have now recovered to nearly pre-COVID levels having been 50% lower at one point.

Steady improvements in Europe

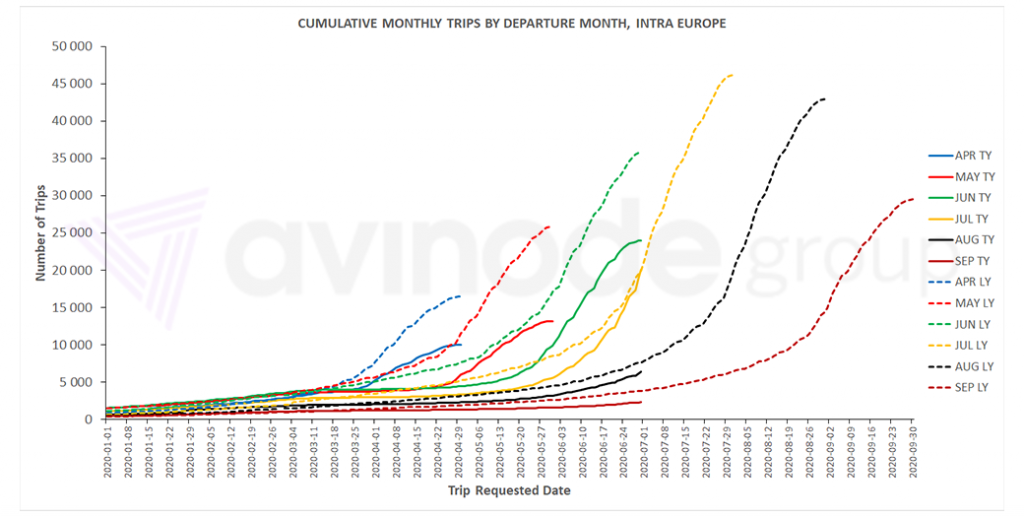

European demand has continued to increase in recent weeks. The chart below shows the number of trips by requested date for each departure month, for travel within Europe. Demand for travel in June (green) finished 33% below last year. July (orange) has just reached the same level it had at this stage last year, with a steeper gradient suggesting it will improve further. August (black) is gradually closing on its last year position. Demand is starting to surge from the UK, amid expectations of a loosening of quarantine on return rules for certain countries. France, Spain, Italy and Switzerland continue steady improvements. Demand from Germany has softened slightly, from a peak in mid-June when restrictions were first lifted.

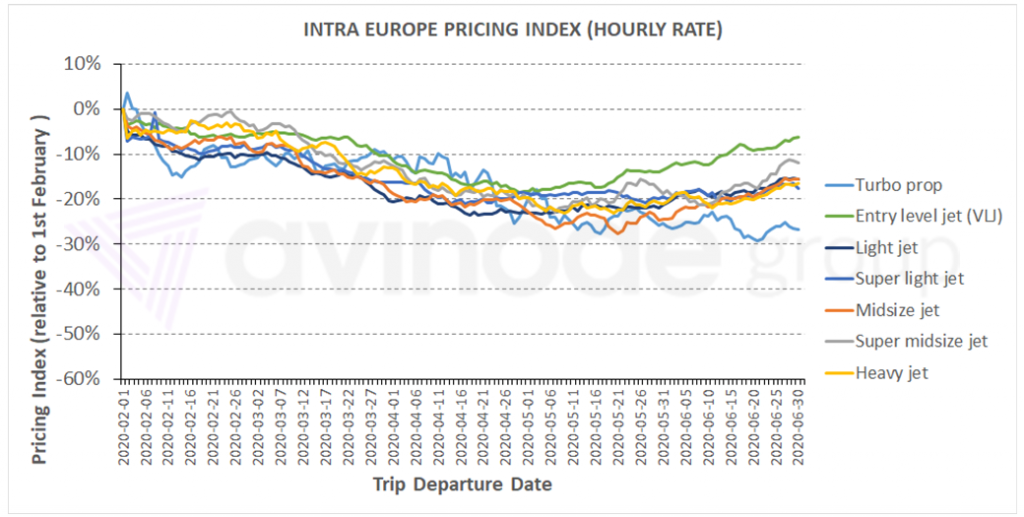

European charter rates reflect the improving demand environment. Hourly charter rates have been in slow recovery since early-May, having hit a low of around -22% when compared to 1st February. Entry level jets have been able to recover more quickly than the other categories. Turbo-prop rates stand out for having not started their recovery yet.

Outside the US and Europe, Russia continues to see improved demand in July with the most popular trips being domestic travel, and to Italy, Spain and France. Demand to Italy and France is lower than last year (-7% and -28% respectively), whilst Spain is significantly higher. Demand from the Middle East is greater from the UAE than Saudi Arabia; the most popular destination from the UAE is Greece, whilst from Saudi Arabia it is Spain.

Harry Clarke,

Head of Insight, Avinode Group