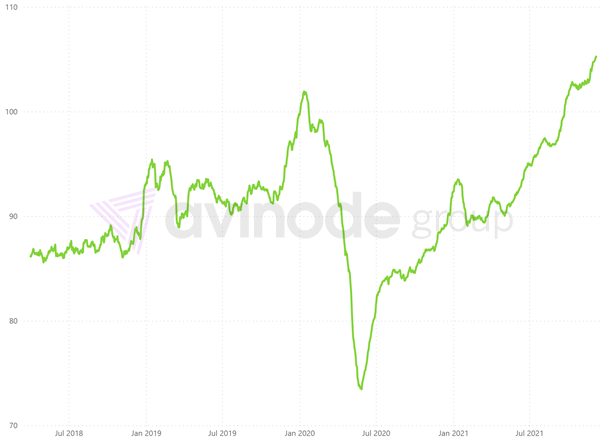

The US domestic market has boomed this autumn. The Avinode demand index climbed steadily since the turn of the year and reached new heights over Thanksgiving, matching the record number of flights that took place. Our forecast – based on a mix of prior year data and forward-looking request data – is indicating that Christmas and New Year traffic could be even greater. The watch out is how reliable Christmas 2020 can be as an indicator for Christmas 2021, given the very different factors at play – including the vaccination roll out, commercial aviation schedules and the community spread of omicron.

Looking at the festive period in detail, Boxing Day – which falls on a Sunday this year – is the big travel day, with return journeys focused on Sunday 2nd January. There is a large flow of demand taking folks back up to the colder northern states after some time in the Florida sunshine. Trips to ski breaks in the mountains are showing a similar pattern but with some earlier demand too – arrivals into Aspen are very strong on 17th and 18th December. The big international markets are Mexico, the Bahamas, Sint Maarten, Turks & Caicos, and the Dominican Republic.

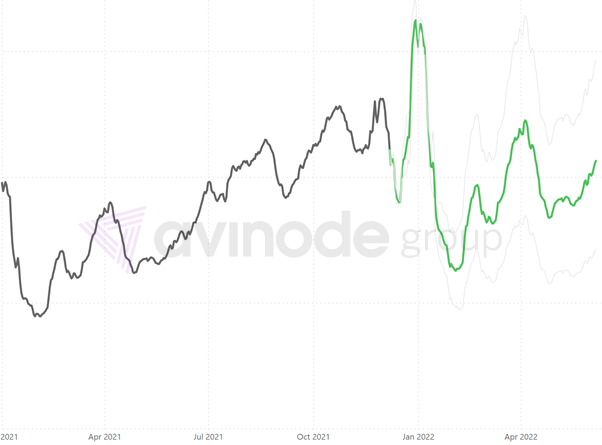

With high demand and low supply mixing with high fuel prices, it is no surprise that rates are increasing. The Avinode hourly rates pricing index for the US has been rising since the start of the year and is at record levels for all aircraft bar super midsize jets, which peaked in October. With such record activity and increasing rates, it has become more challenging to get quotes that reflect the final price of a trip.

To counter this effect, we added a price estimate column in search results last year, creating transparency between our brokers and operators. When sorting on estimate price, it gives buyers a better idea of the final price. In this challenging market situation with low supply and high demand, I recommend using the estimate when searching for aircraft.

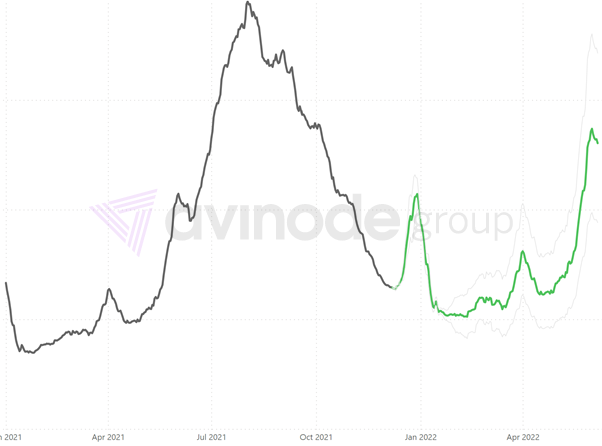

Intra-European charter demand through Avinode has followed its typical seasonal pattern but with a shallower slope down from the summer peak than previous years. The Christmas holiday peak is expected to follow the same daily pattern as in the US, with an added busy travel date on Sunday 9th January. Looking further forward, the UK to Alps ski peak on Saturday 12th February – with return a week later – is already taking shape. Chambery and Innsbruck are most popular.

From Russia, demand is focused on Sunday 2nd January with the return taking place on Sunday 9th January. France and Switzerland are in the top 3 most popular destinations, with the Maldives in second place. Dates between 25th-29th December are also busy, but for this period it is the Maldives and Dubai that are the most popular destinations. Despite their popularity, the Maldives and Dubai are down 30-50% compared to last year – ski holidays are back in demand.

Hourly rates within the intra-European market are slightly higher than November 2019, having rebounded throughout the summer. Rates are most robust in the Entry Level Jet category – up around 10% on 2019. Hourly rates are also high for Light Jet and Super Light Jet categories, up around 4%.

Of course, the big question mark is how much tighter travel restrictions may get. Undoubtably the tougher restrictions are, the longer it will take commercial aviation to recover. This could mean a continuing opportunity for private charter to woo new clientele into 2022.