Trip demand index rises

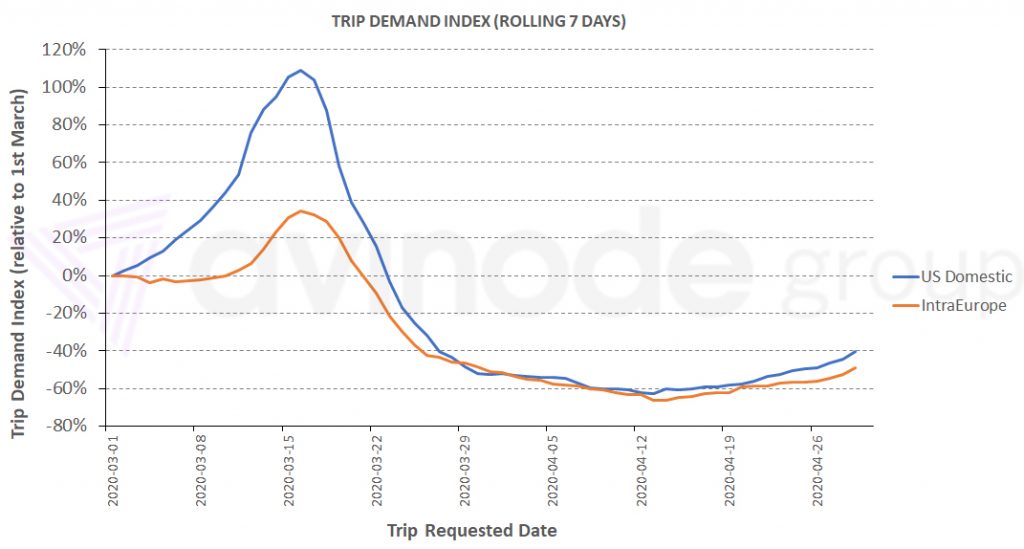

The chart below is a rolling 7-day index of demand normalised to 1st March, for trips requested through the Avinode marketplace. Demand for US domestic (blue) and intra-European flights (red) has risen over the last week. Yesterday saw the most demand pass through Avinode for US domestic trips since the 20th March and for intra-European trips since 19th March. This means our trip demand index – a rolling 7-day average – looks set to go up over the coming days.

Demand increases in May

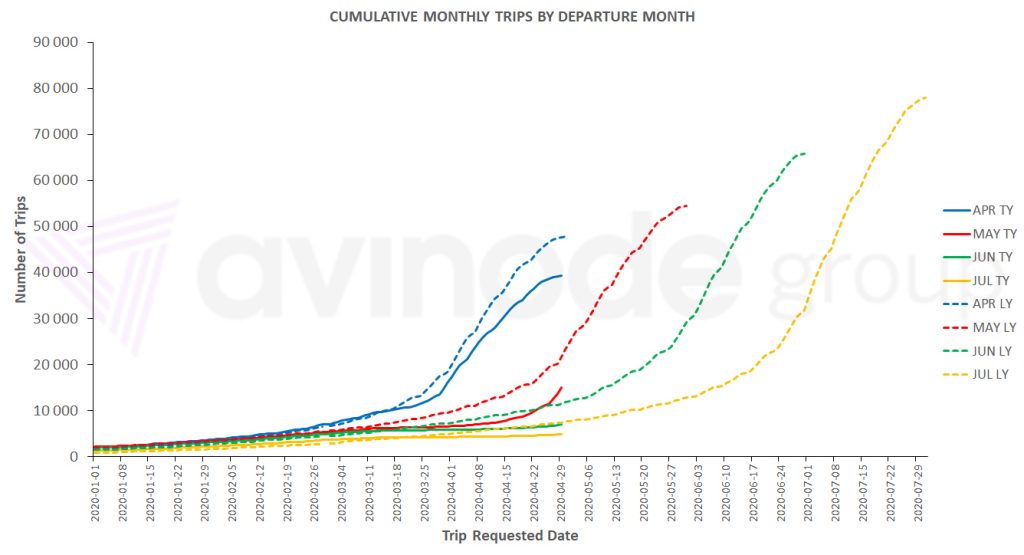

The below chart shows the cumulative number of trips for each departure month, per requested date, for the global charter market. It enables us to understand for which dates of travel the demand is for. Departures in May (red) have seen a resurgence in the last week; it is now 30% below its position last year. June (green) and July (orange) are staying reasonably flat relative to their last year curves. Demand is coming in for the summer, but most remains focused on travel in the nearer term.

Intra-European demand

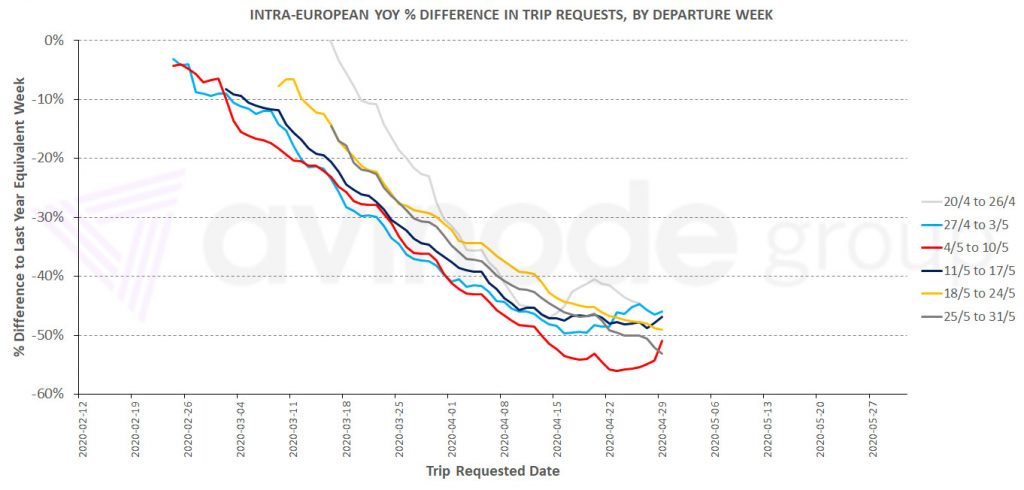

The graph below shows the % year-over-year difference in trips by requested date, aggregated up for each departure week, for intra-European travel. Whilst the trip demand index relative to 1st March shown at the start of the article is positive, most future weeks are quite flat on a year-over-year basis. This is because we would normally see strong seasonal growth at this time of year as the weather across the continent improves. Whilst the demand situation is improving, it is not enough to reverse year-over-year trends.

The exception appears to be the week of the 4th to 10th of May (red), which is going up. Portugal and Norway are showing the best year-over-year figures. There is a small demand peak appearing for French domestic travel on the 12th May – the day after lockdown is relaxed slightly. With no exit plan announced so far, demand for travel from United Kingdom remains depressed. It is down 61% between 1st and 20th May, compared to the equivalent stage of the booking cycle last year.

US domestic demand

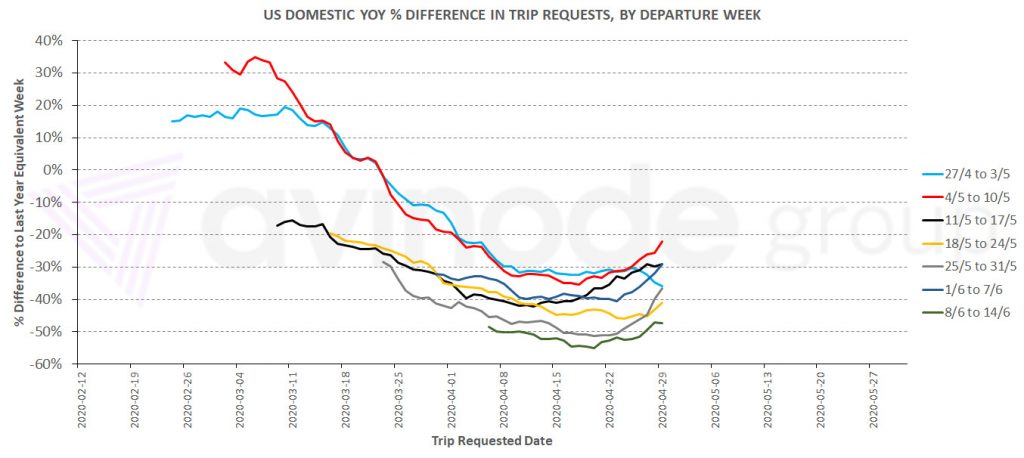

The situation is different in the United States. With a much smaller seasonality impact, the improvement relative to 1stMarch does result in improvements to the year over year figures. The chart below shows that demand is returning for travel throughout May and June. With the federal government not extending social distancing guidelines beyond today and more states announcing relaxations, pent up demand for private charter looks to be revealing itself.

As stated last week, this demand is heavily focused on travel from the Southeastern part of the US – in particular, Florida – up to the Northeast and Central regions, throughout May. This indicates that demand is still driven by people returning. Not until demand also recovers on the reverse itineraries can we say that normal conditions have returned on the East Coast corridor. The figures for travel from the Northeast and the West are still low. It remains the case that travel within regions see worse year-over-year figures than travel between regions.

Elsewhere, with lockdown just extended in Russia until 11th May, pent up demand for travel this weekend would seem unlikely to convert to flown movements. For transatlantic travel, there is a small demand spike appearing for travel from the US to Europe around the 15th May. Across May as a whole, demand from the US to Europe is higher than it was at the equivalent stage last year, but not to the core UK and France markets. Demand from Europe to the US is down. We still see increased demand through Avinode for travel to and from Asia in May.

Demand is returning, but at different rates, in different places and at different times. Our normal demand environment is still a way off.

Harry Clarke,

Head of Insight, Avinode Group