Small increase in future demand

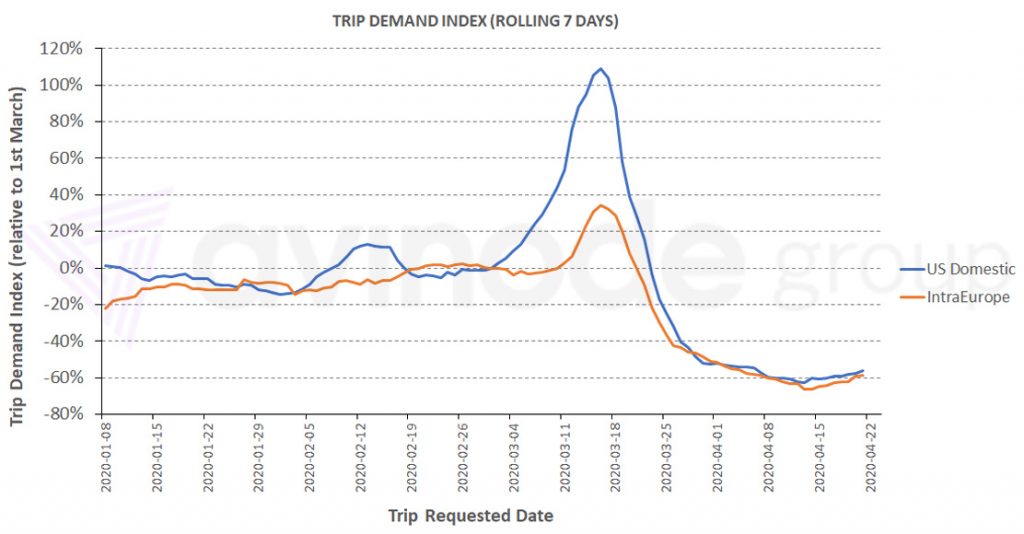

The chart below is a rolling 7-day index of demand normalised to 1st March, for trips requested through the Avinode marketplace. Demand for US domestic (blue) and intra-European flights (red) has risen over the last few days. It increasingly appears that Easter may have been the low point of the demand trough. Yesterday saw the most demand pass through Avinode for US domestic trips since the 23rd March. The trip demand index below seems likely to go up for the US but remain flatter for Europe.

Global charter market

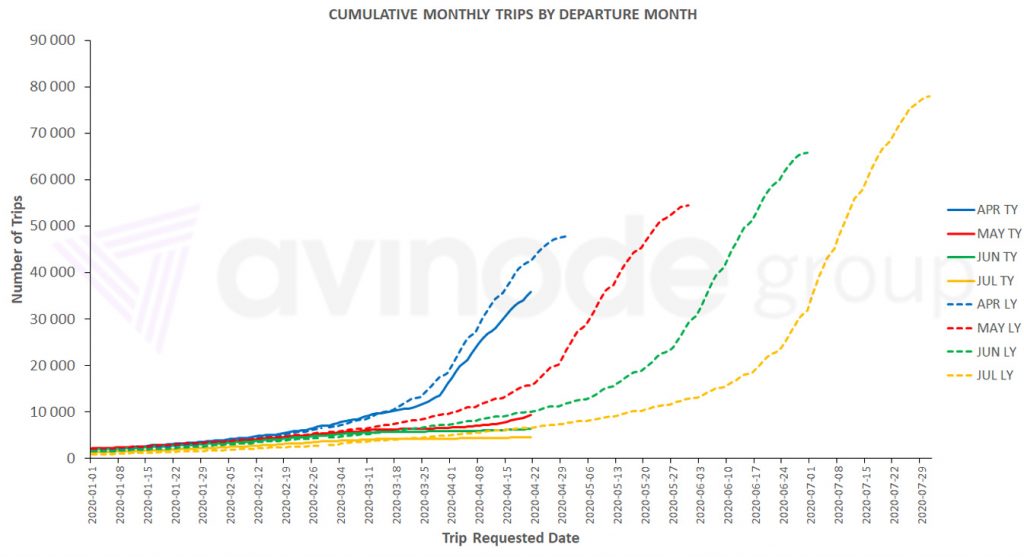

The below chart shows the cumulative number of trips for each departure month, per requested date, for the global charter market. Demand for departure in April (blue) is 16% below what is was at the equivalent time last year. Looking further out, May (red) is 40% below where we would expect it to be in normal demand conditions. June (green) is 36% below; June and July have improved relative to their last year curves, just a small amount, for the first time since I started sharing these figures back in March.

End of lockdowns brings demand

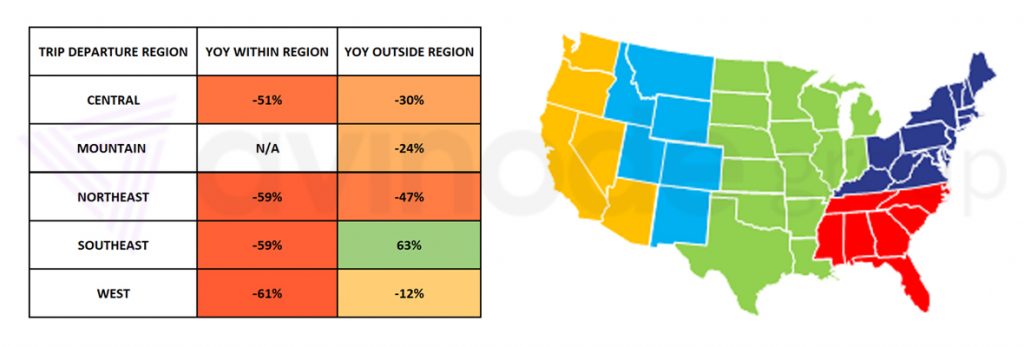

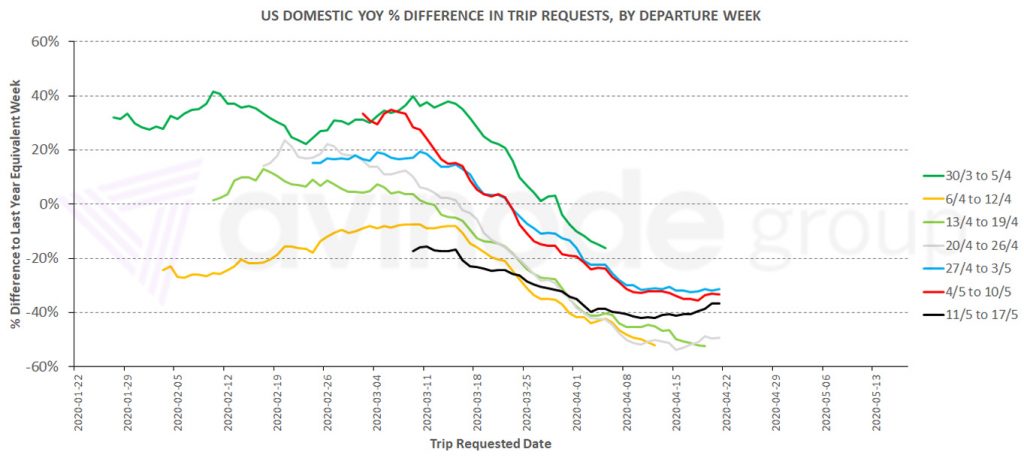

What is causing the small improvement in charter demand? The data suggests it is concentrated around the end of lockdowns. In the United States, stay at home orders end on 30th April for Florida and 15th May for New York. On and very shortly after the 30th April, there is elevated demand for departure from the Southeast to the Northeast and Central regions.

This occurs again on and just after the 15th May. There is improved demand for interregional travel from the Southeast too during the intermediary period. The 15th May also sees elevated demand from the West and Mountain regions to elsewhere in the US. As of right now the demand is only for interregional flights, not short hops, suggesting the demand is from those who “bunkered down” for lockdown and are planning their trips back home. This demand converting to actual flown movements appears to be contingent on lockdowns not being extended.

“This demand converting to actual flown movements appears to be contingent on lockdowns not being extended.”

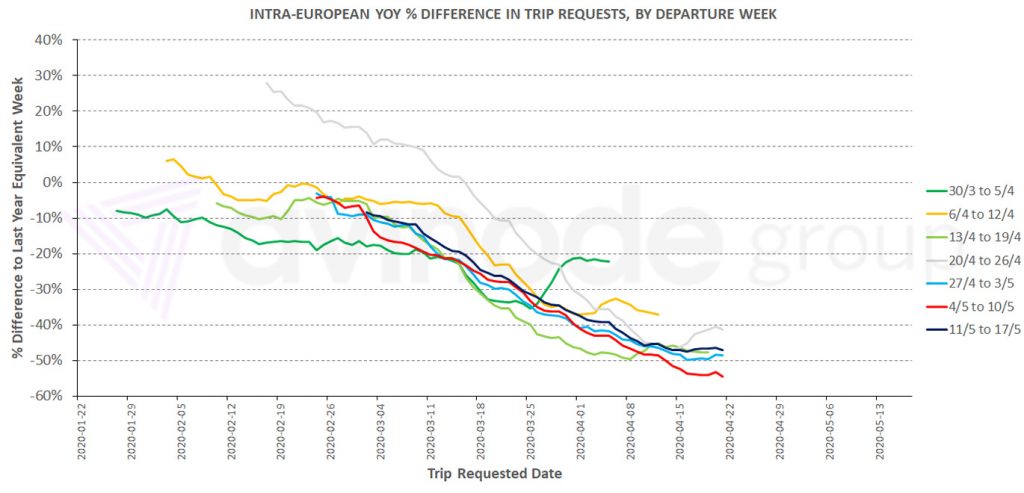

A less clear picture in Europe

The graph below shows a flatter picture in Europe over the coming weeks. The small spike on Monday is probably more related to comparing a normal Monday this year to Easter Monday last year. Demand spikes on a departure country level are less defined here than they are in the US. A well-publicised wave of demand for large cabin aircraft to carry fruit pickers from countries in Eastern Europe to Western Europe appears to be dying off – although those with more farming knowledge than I might have a better idea of when more workers could be required.

What about other regions?

In Russia, where lockdown is currently scheduled to end on the 30th April, there is a spike in demand on 30th April and 1st May; Turkey, Spain, the Maldives and Greece are the most popular destinations. These dates also see a smaller spike for travel back to Russia. Elsewhere, the same dates see a spike in requests for travel from the Caribbean and Central America to Canada and the US. Trends are less certain in Africa, Asia and the Middle East.

The situation is fluid – lockdown end dates could be confirmed or extended at any time. However, if lockdowns are ended, Avinode data indicates that there will be an uptick in charter demand. A word of caution though; currently demand is still quite spikey around end dates and generally remains heavily depressed elsewhere, suggesting we are approaching an end of lockdown rush, rather than a return to normal conditions.

Harry Clarke,

Head of Insight, Avinode Group