A flat trend

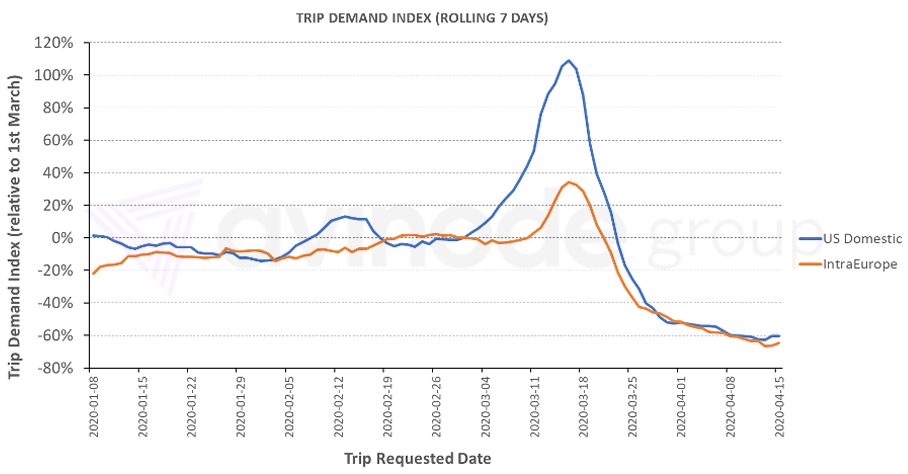

The chart below is a rolling 7-day index of demand normalised to 1st March, for trips requested through the Avinode marketplace. Demand for US domestic (blue) and intra-European flights (red) has risen a marginal amount in the last couple of days, after a poor Easter. The trend is essentially flat.

Global market demand

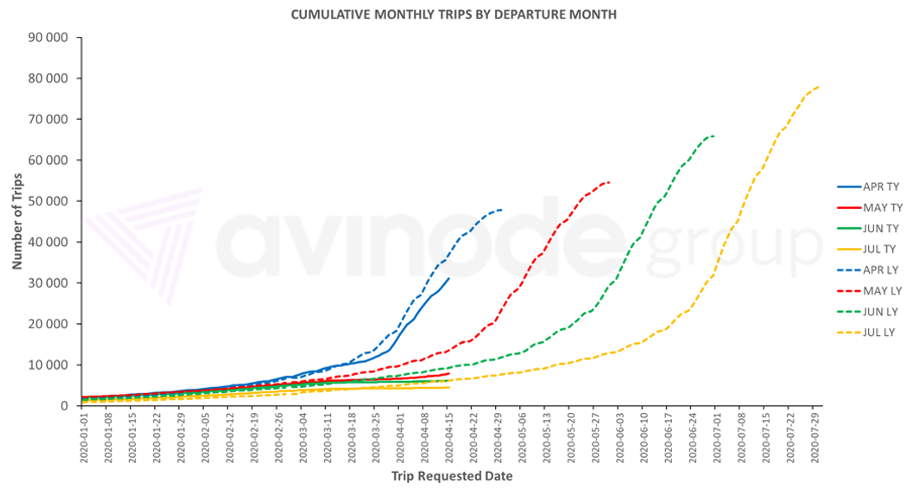

The below chart shows the cumulative number of trips for each departure month, per requested date, for the global charter market. Demand for departure in April (blue) is 16% below what is was at the equivalent time last year. Looking further out, May (red) is 42% below where we would expect it to be in normal demand conditions.

Intra-European vs. US domestic requests

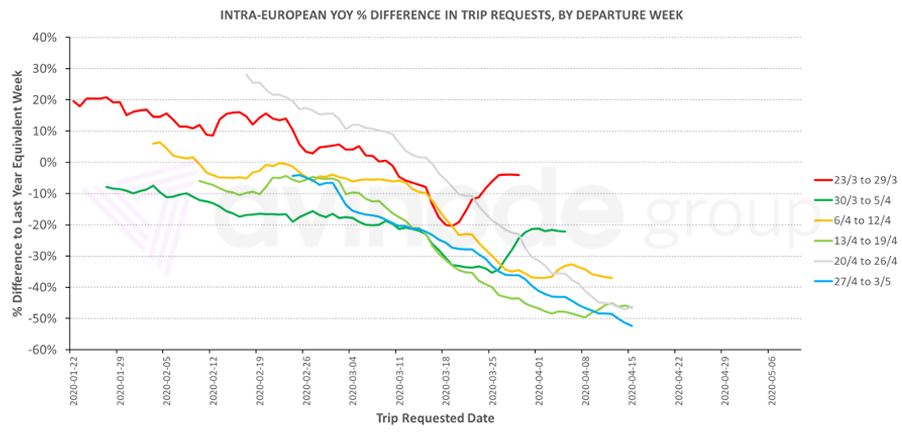

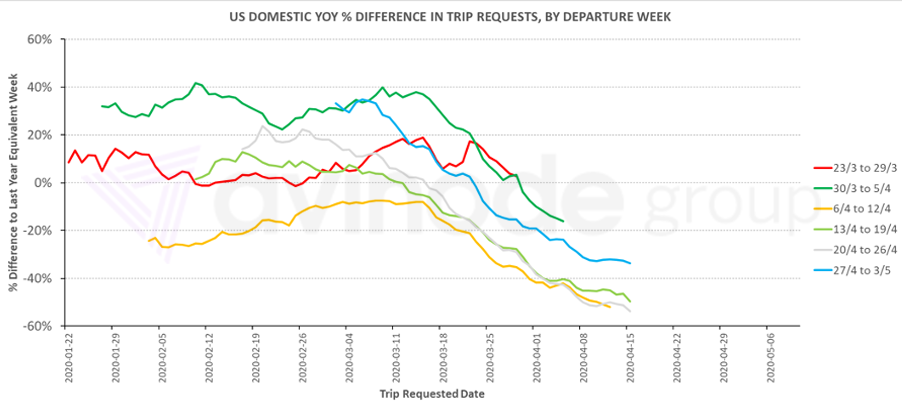

The surprising robustness of April’s figure is caused by intercontinental demand passing through the Avinode marketplace. The figures for intra-European and US domestic flying for the coming weeks are lower, as shown below in these weekly aggregations detailing the percentage difference in trip requests for each departure week, compared to the equivalent weeks at the same stage of the booking cycle last year. Future weeks continue to decrease compared to their last year equivalents, with small ups and downs across weekends and due to the movement of Easter.

“Thinking positively, there could be some very high demand days in the latter half of 2020 as postponed events overlap with unaffected normal events.“

Despite some positivity this week, such as Danish children returning to school and lockdown exits being planned elsewhere in Europe, the June and July numbers show that the proportion of consumers happy to make summer plans is still far below normal. When normal leisure demand does return, the absence of events that have already been cancelled, such as Wimbledon and the British Open Golf, will have a negative impact on the summer. That demand is gone forever. Thinking positively, there could be some very high demand days in the latter half of 2020 as postponed events overlap with unaffected normal events.

What about charter rates?

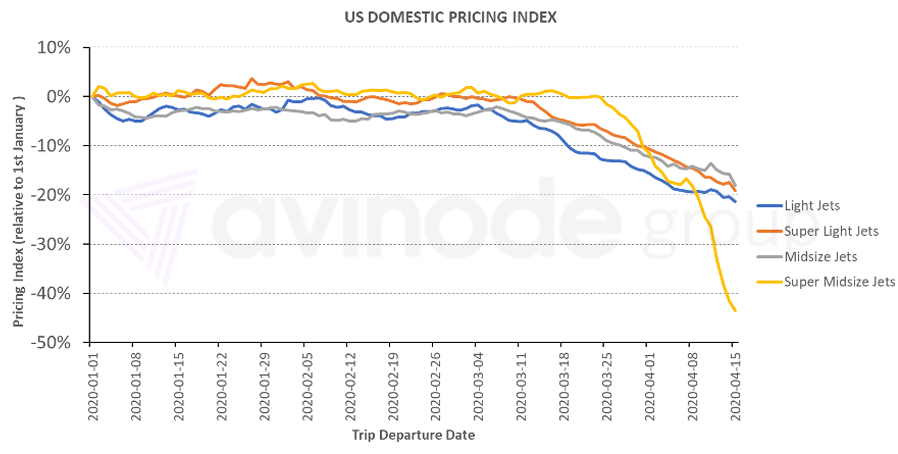

The below graph is a pricing index for US domestic trip requests, indexed to 1st January 2020, per departure date. It is based on the median price per hour quoted for accepted trips received within four weeks of departure, for the four most quoted aircraft categories in Avinode for US domestics in April.

It shows a general decrease in median hourly rates for light, super light and midsize jets since the beginning of March. There is a remarkable 44% drop off for median hourly rates for super midsize trips since the end of March. Fuel prices, decreased lead-times before departure and overall demand will all have impacted this. It is a competitive market.

Harry Clarke,

Head of Insight, Avinode Group