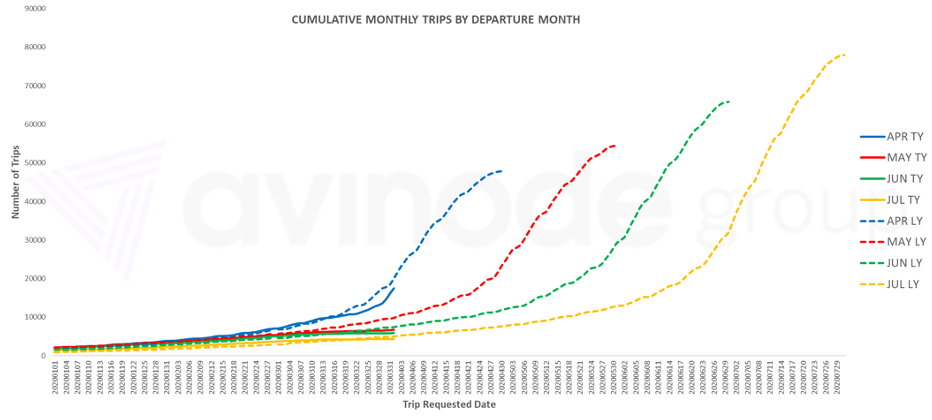

Cumulative monthly trips

The below chart shows the cumulative number of trips for each departure month, per requested date, for the global charter market. Demand for departure in April (blue) is 13% below what is was at the equivalent time last year and I expect it to decline further as we move into the month. Looking further out, May (red) continues to decline compared to last year. I think it is important to keep looking at this graph as we move through this crisis. It will give us a good early indication of when normal demand conditions are returning, as different countries relax their movement restrictions.

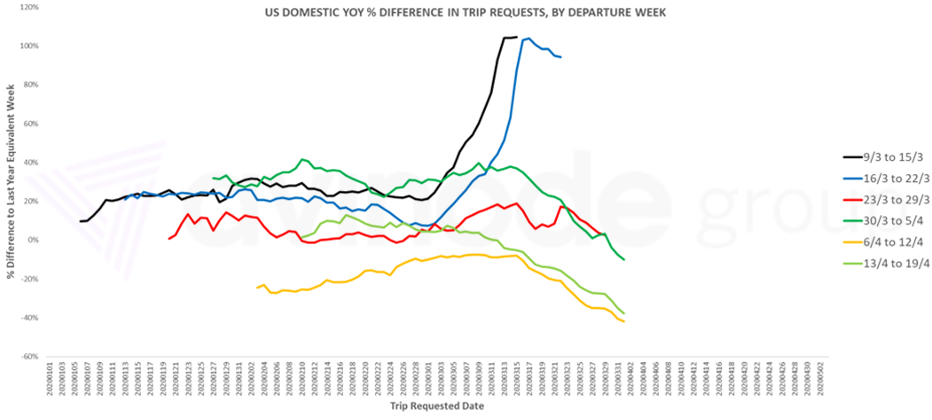

US demand

Last week I commented that US-domestic demand had shown positive signs before softening slightly – unfortunately the trends have been fully negative since then. The chart below shows demand for this week (green) in decline, as are the following weeks over Easter. The continuing escalation of the severity of the crisis in the US is being reflected in the data. We hoped that one effect of COVID-19 would be that commercial passengers would fly private instead. Right now, with so few people travelling at all, that does not appear to be happening to a significant degree. I think we may see some benefit from this effect when the strictest restrictions are lifted.

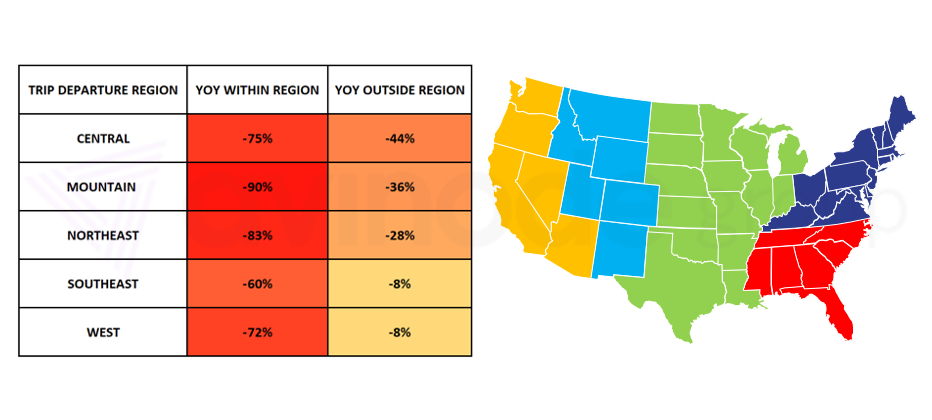

Regional US demand

The matrix below shows the year-over-year percentage decline within and outside different regions of the US, grouped by state according to the map, for departure next week (6th to 12th April). The deep reds in the left-hand column indicate that local travel is the worst affected. Charter demand for longer journeys, such as up and down the East Coast, is more resilient.

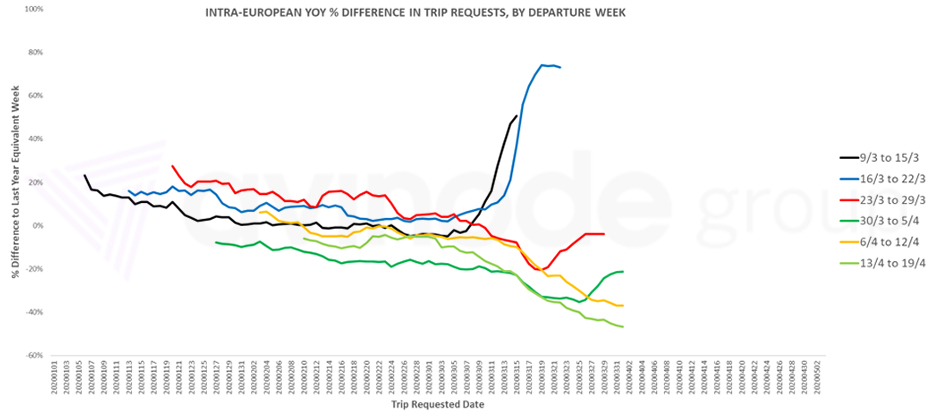

Intra-European trip demand

Intra-European trip demand is showing the same negative trends, but with the difference that we are seeing a small recovery within the last few days before departure. Trips for departure this week (green), have shown more demand in the last few days than during the equivalent week last year. I expect we will see the same pattern for subsequent weeks into April. Overall demand will be substantially lower than usual, but with a small uplift in the last couple of days before departure. At the country level, Italy is the worst affected major market, with Intra-European charter demand for next week down 65%. The UK and Germany appear to be faring slightly better than Switzerland and France.

“Italy is the worst affected major market, with Intra-European charter demand for next week down 65%”

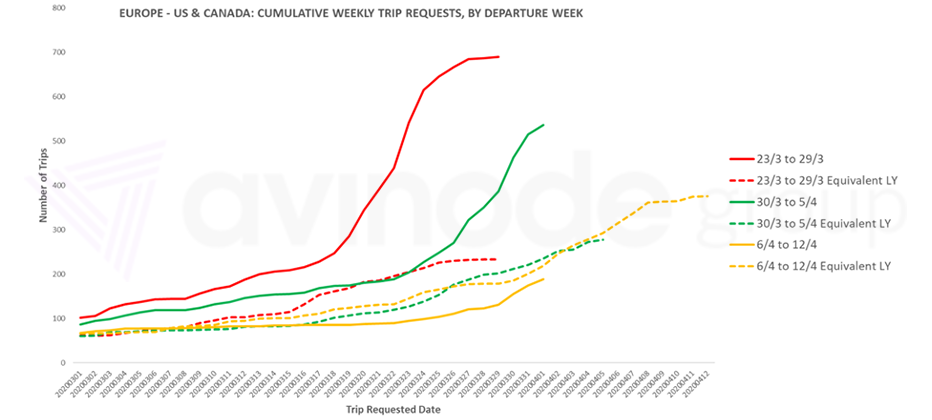

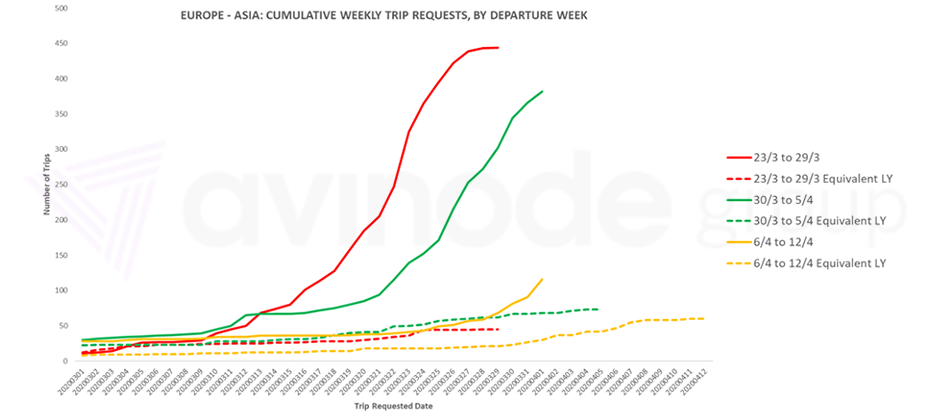

Intercontinental stays positive

Intercontinental charter remains the major segment of our industry that is still seeing positive trends. The below charts show charter demand on transatlantic flights and demand between Europe and Asia (and vice versa). Transatlantic travel is still much more in demand this week (green) than it was for the equivalent period last year, and demand for next week (orange) is tracking a similar gradient to last year. Demand between Asia and Europe has surged this week (green) and appears to be doing the same for departures next week (orange). Other regional flows seeing elevated demand include the US & Canada to Asia, and from Africa to Europe and the Middle East.

“COVID-19 is a constantly evolving situation. The last couple of days has bought positive news in some countries and negative news in others”

COVID-19 is a constantly evolving situation. The last couple of days has bought positive news in some countries and negative news in others. This analysis indicates the future demand for private charter as of today – much could change in the next few days.

Harry Clarke,

Head of Insight, Avinode Group