Global charter

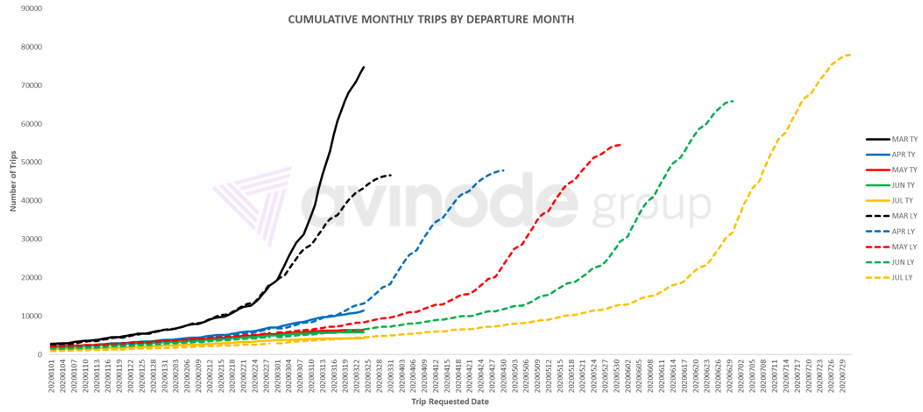

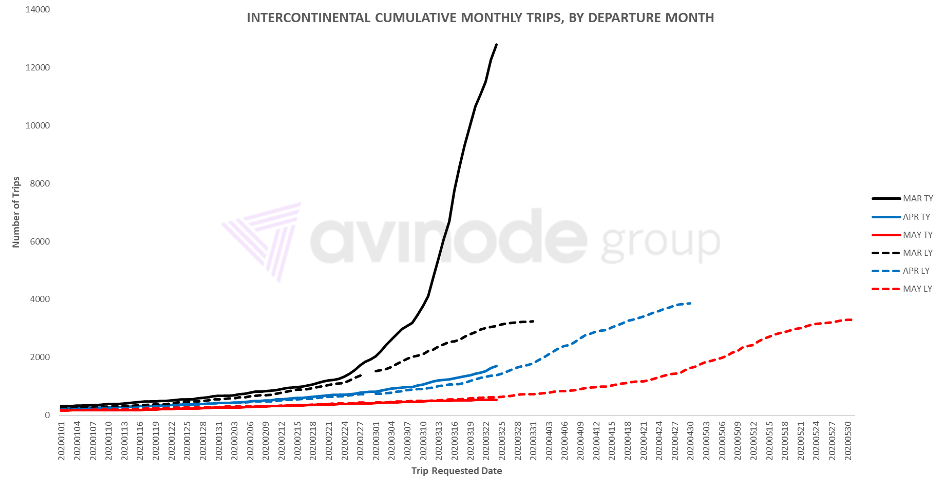

The below chart shows the cumulative number of trips for each departure month, per requested date, for the global charter market. In the short term, March (black) continues to see high demand compared to last year (black dash). Looking at the medium term, April (blue) is a lower gradient than last year and May (red) continues to decline – now 23% lower than at the equivalent point last year. It is too early to expect much demand for June and July.

Short term demand

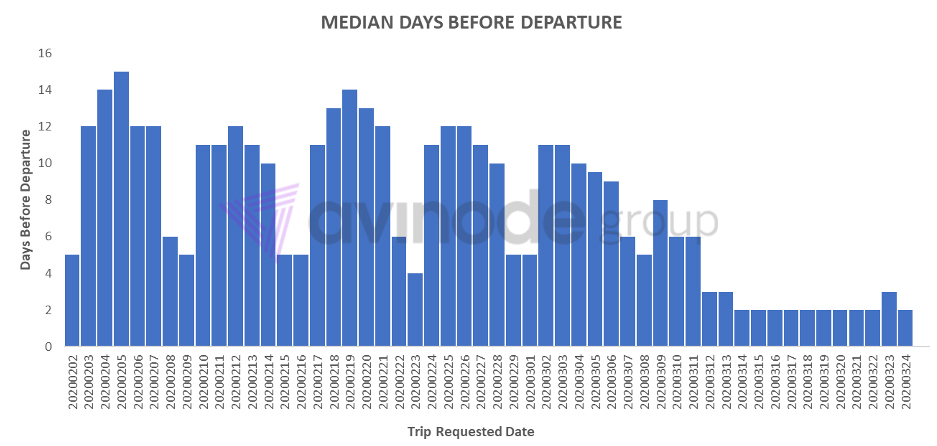

We have entered a demand market that is dominated by the short term. The below graph shows the median days before departure that a trip is requested at. Throughout February the pattern was normal; the median was around 12 on weekdays and 5 at the weekends. For the last week, the median has never been higher than 3. Whilst these market conditions continue, we should expect that future demand curves will look more like hockey sticks; they will be flat, and then accelerate at the end. Brokers and operators that can act fast will be able to better take advantage of demand.

Intra-European recovery

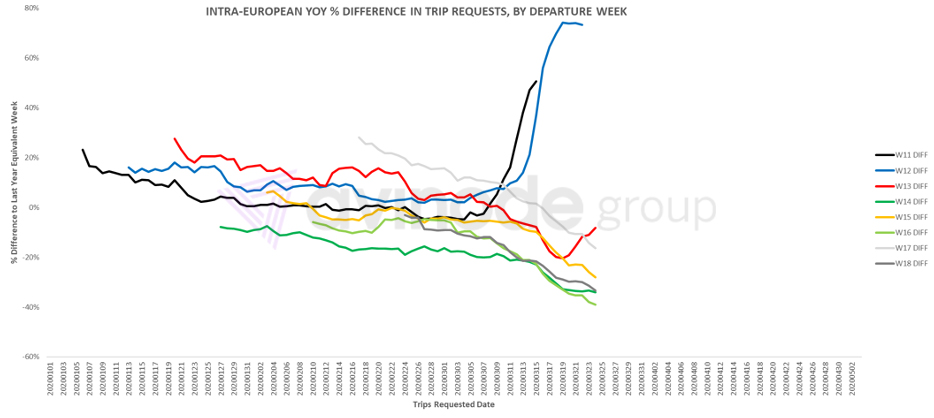

Intra-European trip demand – which was looking negative as of the end of last week – has made a small recovery in the last few days. Trips for departure this week, between 23rd and 29th March (red), have increased compared to last year. The strong decline for next week (green) has flattened off too. Subsequent weeks into April continue to decline, but as explained above, we would expect demand to return to those weeks closer in. Overall demand will be lower than usual but expect upticks at short notice as countries change their restrictions.

No abrupt stop

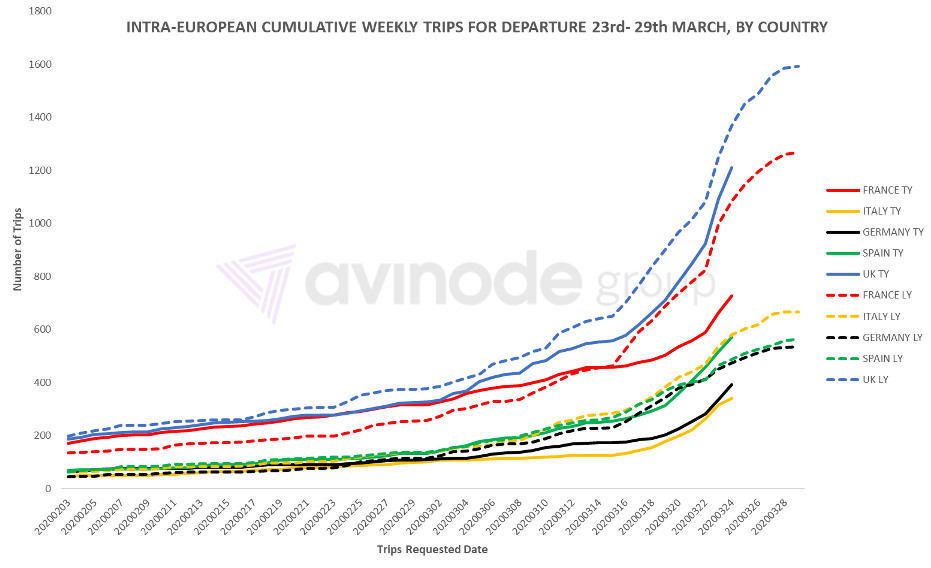

The graph below highlights charter demand for departure this week, for Intra-European travel to, from and within the five largest country markets. Germany (black), Spain (green) and the UK (blue) appear to have more resilient demand than France (red) and Italy (orange). Demand for charter, whilst weaker than usual, has not come to an abrupt stop – even with lockdowns in place.

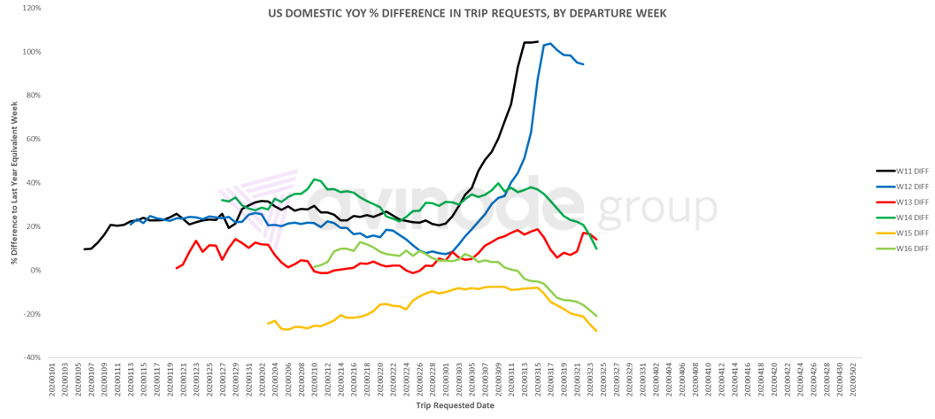

Some positivity for US domestics

US-domestic demand also showed positive signs over the weekend. The chart below shows that demand for this week (red) reversed its negative trend, with a softening yesterday. The following week is still in decline. We appear to be seeing similar patterns in short-term demand in both the US and Europe, although there is perhaps more uncertainty in the US market, as it is unclear if restrictions will become stricter or looser in the next couple of weeks.

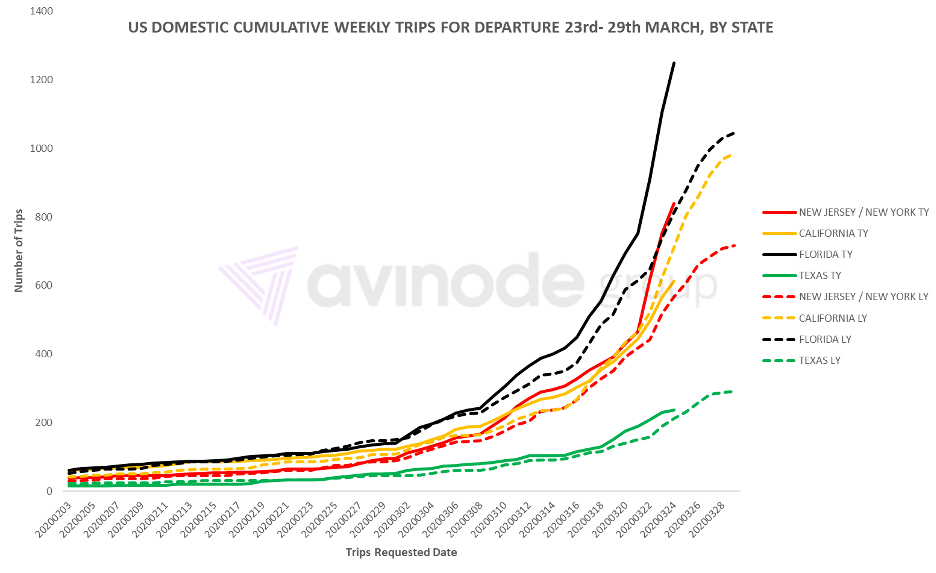

East coast increase

When looking at domestic demand departing or arriving into the biggest markets within the US, for departure this week, it is clear that US domestic demand is focused on the East Coast. The New York area and Florida are seeing large increases in demand compared to last year, whilst California and Texas are closer to their last year demand curves and starting to drop behind.

Intercontinental charter

Intercontinental charter is still in demand. In contrast to other markets, the mid-term trend is still positive – as shown by the April data below (blue). Right now, we are seeing more demand than usual out of Africa, Latin America and Oceania.

COVID-19 is an evolving situation. This is the state of forward charter demand as of today – it will continue to shift rapidly.

Harry Clarke,

Head of Insight, Avinode Group