In the charter sphere, numerous cancellations of existing bookings have been compensated for by a short-term boost from repatriation flights, leading to Avinode breaking its trip request record on three occasions in the last week. Many in the industry have sensibly warned that this short-term increase in demand will be followed by a long-term decrease.

Charter demand globally

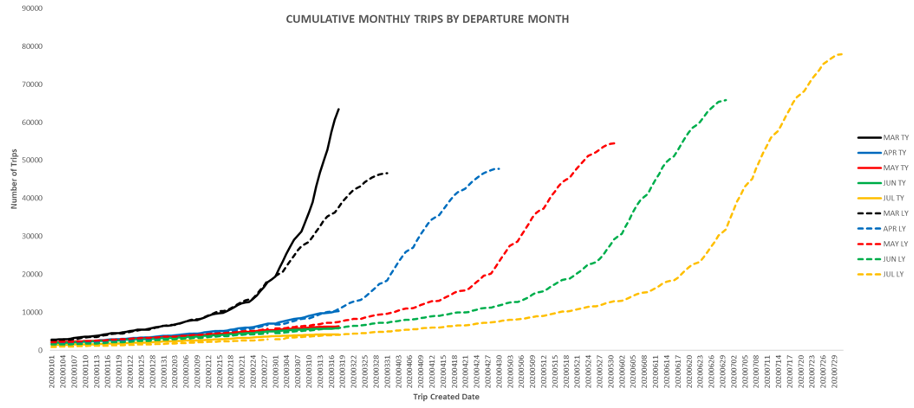

Globally, there is still strong charter demand – if it can be fulfilled – for the next week or so. The chart below shows the cumulative number of trips for each departure month, per requested date. March (black) is clearly far ahead of last March (black dash), after demand started to surge at the beginning of the month. April (blue) is flattening and has now crossed its demand curve last year, indicating it may soon start to fall behind. May (red) is faring worse. It is 16% behind its position last year.

Looking at June (green) and July (orange), what is obvious from this chart is how late booking private charter is. We expect most trips to be requested in the month of travel. Even if there were no requests for trips in July during the whole of April, only a small increase in demand would be required to get back on track.

Currently demand reductions are primarily driven by travel restrictions, so demand could bounce back quickly when they are lifted. Whether it does or not depends on the state of the global economy by that point.

Intra-European trips

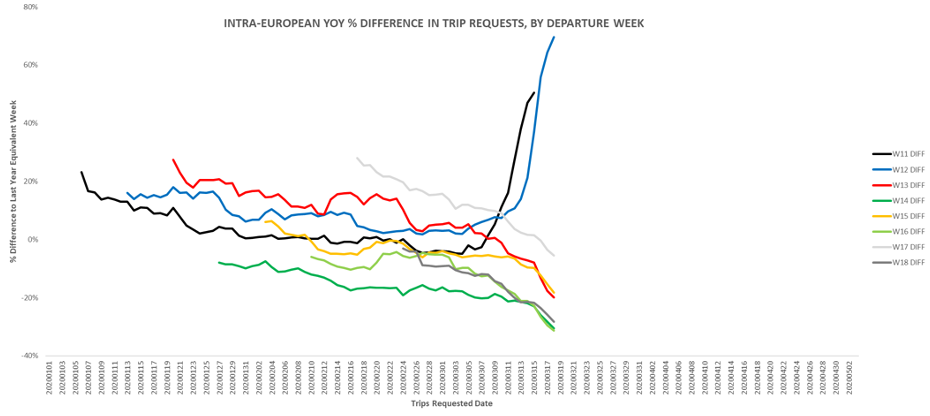

Intra-European trips are beginning to suffer from the unprecedented travel restrictions imposed by most countries. The chart below shows the year-over-year (YOY) percentage change in trip requests for comparable weeks.

This week, between 16th and 22nd March (blue), is still far above last year. Trips requested for departure next week (red) have declined down to 20% below last year. The exact YoY weekly impact is affected by Easter being one week earlier than last year, but all weeks up to the end of April are now negative.

Charter will play a crucial role in addressing the crisis and the movement of critical cargo. This shift to a higher proportion of close-in demand will probably result in steeper gradients at the end of demand curves – so I have some hope that negative trends could reverse as they approach their ends. April is likely to be a very tough month nether the less.

US-domestic demand less alarming

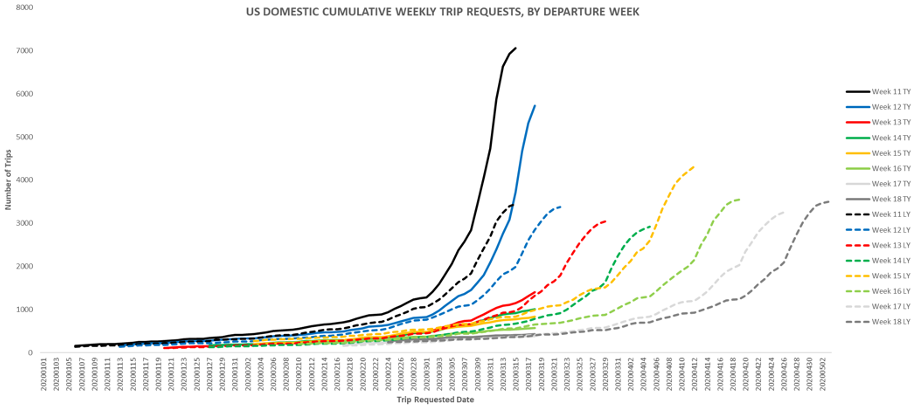

Right now, the status for US-domestic demand is less immediately alarming. The chart below shows that future weeks are not far from their last-year demand curves. However, the last three days have seen a drop in their gradients, suggesting they may struggle to keep pace in the coming days.

Whilst the United States is not subject to domestic travel bans, hopefully private charter can absorb some of the leftover demand from those concerned about travelling on commercial airlines – however the data does not suggest that this stream of demand will amount to a “boom” for private aviation in the US. Overall demand is still likely to suffer.

Intercontinental charter

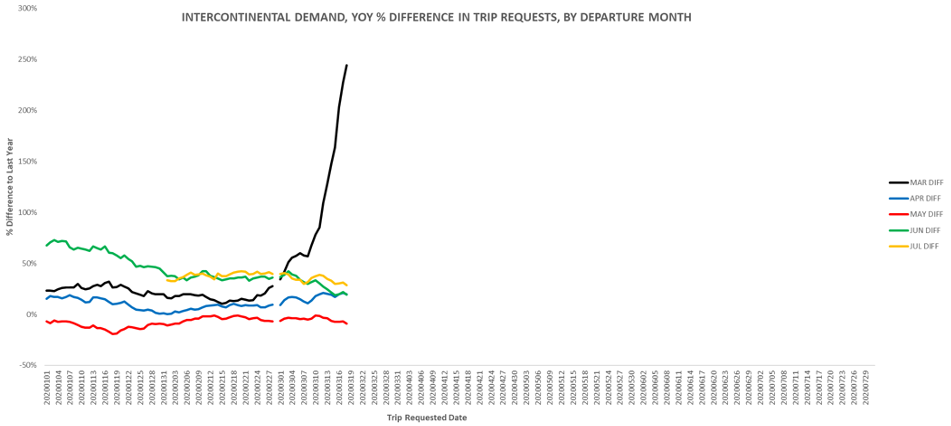

Intercontinental charter is a very small market compared to the two markets already addressed. It is also the one seeing the biggest swings in demand. March (black) demand has been driven by a huge boost in transatlantic repatriation, but for the next couple of days the demand has shifted more to travel into Asia and the Middle East from Europe and the US.

Overall intercontinental charter demand is still on a positive trend into April (blue). As different regions of the world experience the peak of the COVID-19 curve at different times, global repatriation and reopening will continue and shift focus. The intercontinental charter market could prove more resilient than other parts of our industry.

COVID-19 is a strange and worrying time for everyone involved in the aviation industry. I hope this data has provided some insight into what impact it is having for private charter in future months. I will be sure to update as the crisis continues.

Harry Clarke, Head of Insight, Avinode Group.