In Europe, Vista Jet and Globe Air are at the forefront of this trend. From the start, both companies have been subject to questions concerning the viability of their business model. In the US, XOJet, a California-based operator owned by TPG, has been leading this new development. XOJet offers a transcontinental one-way pricing scheme using two different aircraft types, the Citation X and Challenger 300, where the client only pays for the actual flight. In March this year, the company decided to go from wholesale to retail, leaving the brokers out of the loop and directly targeting the end consumer.

JetSuite is also a California-based operator and claims to be the only charter operator in the world to guarantee instant quotes through their online booking engine. They’re one of the few light jet operators from the VLJ era that has survived, presumably by working with a network of partners and affiliations and by constantly evaluating new methods to reach new clients through their retail strategy, for example, by posting last-minute deals on Facebook.

TMC is the third US operator we’ve been looking at. With a fleet of 36 Hawker 400s and 30 Hawker 800 850s spread across the US, they operate in the space between JetSuite and XOJet. TMC and XOJet also have a collaboration deal in place where XOJet resells 8 of TMC’s Hawker 800.

Flight statistics

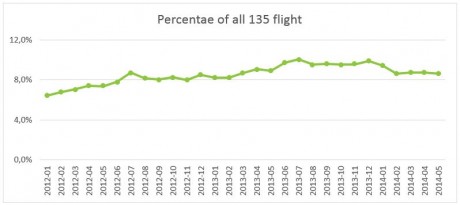

Looking at the total number of 135 flights in the United States, XOJet, JetSuite and TMC combined account for an average of 9.3% per month. The peak was in June 2013 where they accounted for 10.1% of all flights. Note that in reality this percentage is significantly higher, since the FAA data doesn’t show when a Part 135 flight is being used by the owner. If a third of all Part 135 is owner-related, it means the percentage is around 14%.

Looking at hours flown, the market share of the three companies is somewhat higher with an average at 10.1% per month. This is mainly driven by XOJet’s route patterns with longer than average flights, resulting in an increase of the share to 4.3%. JetSuite experiences a decrease down to 1.8%, and TMC keeps their 4% market share.

2014 so far

In 2014, JetSuite and TMC both got off to a good start: Jan-May numbers show an increase in departures of 15% and 23% respectively. In contrast, XOJet is down 8% in number of departures for the same period. XOJet did however reduce their fleet in February 2013 when they sold 7 Hawker 800XPRs to TMC, which is skewing both XOJet and TMC’s numbers. That said, the month of May could very well be a turning point for XOJet. The company saw a 2% increase in flight activity compared to the same period last year.

XOJet & JetSuite also show very impressive per tail numbers. XOJet did on average almost 90 hours per tail in May, and JetSuite did 76 hours per tail the same month. TMC has an activity level more in line with a normal charter operator with 49 hours per tail on average.

The one-way pricing model reflected in flown activity patterns

An analysis of XOJet and JetSuite’ routing patterns indicate that they have been successful in promoting and implementing their suggested business model where the absolute majority of XOJet routes are within close proximity to one of their bases. JetSuite is doing the same but in a smaller geographical area with the majority of their flights in the triangle San Francisco – Los Angeles – Las Vegas.

XOJet routes

JetSuite routes

TMC’s travel patterns are more scattered, falling somewhere between those of JetSuite and XOJet and your normal charter operator’s diversified route pattern. To sum this up, the one-way pricing model seems to be reflected in flown activity patterns.

A successful business model

The data shows that both XOJet and JetSuite have been and are continuously proving that their business model is working. To do 90 hours per month with a Super Midsize and 70 to 80 hours per tail on a light jet is far above average with a possible return on capital. The capital investment is likely to have been well short of list price, with the OEMs providing heavy discounts. A controlled asset base, combined with aggressive marketing, innovative owners and willingness to take risks mean they have been established in the industry as two of the top brands.

Analysis

Whether or not this new trend is a disruption of the industry, it is too early to say. Operationally, a new model has been established. Commercially, the distribution model remains with broker demand still a key channel for all three companies. XOJet appears to want to change this position and is actively targeting direct customers. However, acquiring direct customers is an expensive game and Netjets is most likely the only brand in the industry to have had past success in this area. In addition, there’s a great risk involved, as you balance old and new distribution channels. Also for the traditional Part 135 players there is a risk involved. If companies like XOJet and JetSuite grow further, pressure for industry changes will follow. A scenario where the Charter 2.0 players dominate is unlikely but we may end with a face-off between two business models: one driven by generating revenue from sold flight hours and the other by generating revenue from managing aircraft.

In business aviation, pioneers are not constrained to flying and designing aircraft. They can also lead the way in how the industry should operate. As the much-anticipated upswing of the industry begins, we are at an interesting point on the fulcrum.