High demand and low supply = higher rates

Private charter is booming in Western markets as vaccine coverage increases and restrictions reduce. In this article I will delve into global pricing and demand patterns for the rest of the summer and early autumn, with particular focus on the USA and Europe.

Various commentators have spoken about the huge surge of private charter movements in July 2021 compared to 2019 data, particularly in the USA. The increase in demand coupled with constrained supply is causing hourly charter rates to recover from their COVID lows and even surpass the levels seen pre-pandemic for some categories.

In the US domestic market, heavy and ultra-long-range jets are recovering but still behind where they should be. Smaller categories of jet are all doing well and are broadly similar to pre-pandemic rates. The category really surpassing historical rates is super midsize jets (up 15%), an interesting symmetry given that this category dropped by far the most in the immediate aftermath of COVID restrictions in Spring 2020. The operators of these aircraft have been very reactive to market conditions and optimizing their rates for them.

The patterns in the intra-European market are a little different. Here rates have been recovering rapidly in July but are still below pre-pandemic levels for the summer season. The exception is for entry-level jets, which have rocketed in recent weeks to around 7% above pre-pandemic rates. This could be caused by first-time flyers entering the market choosing the most affordable jet option and so driving up the prices. As with the US market, it could also partly be due to the operators of this category more quickly optimizing their revenue when the opportunity allows.

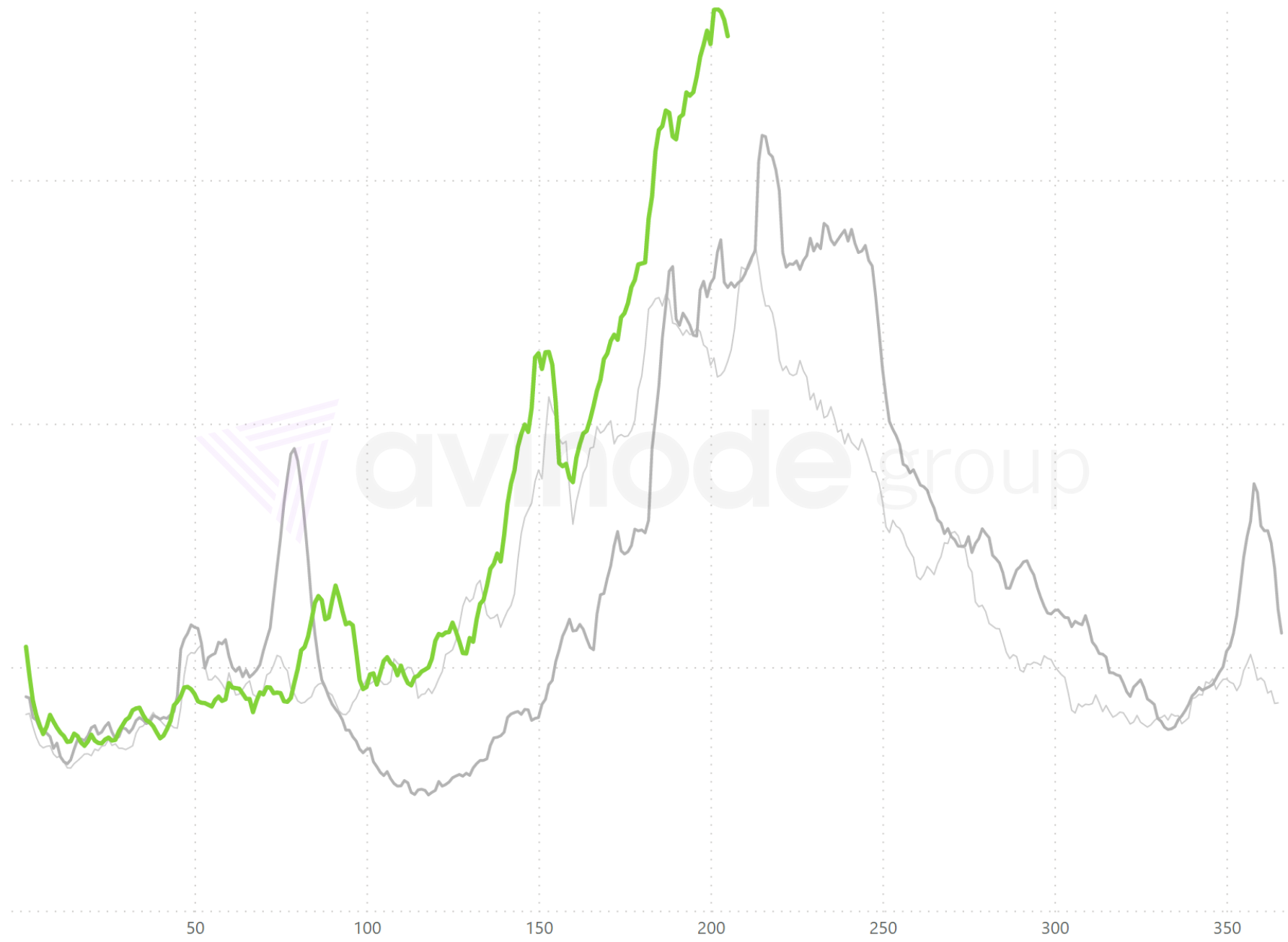

= 2020, Light grey = 2019). Day of year along the horizontal axis. Demand for

2021 has peaked.

Intra-European charter demand through Avinode has just reached its summer peak and is now trending down again; it appears that we are returning to the traditional summer pattern of 2019, rather than the elongated demand into late August that we saw in 2020. However, the Russia to Europe market is still following its 2020 curve; looking at the routes being requested, we should expect to see extra demand from Russia to the Adriatic and Eastern Mediterranean in the next couple of weeks.

Within Europe, Greece has been the star attraction this summer. Early demand patterns, compared to at the same stage of 2019 and 2020, suggest that will continue until at least mid-September. France, Italy, Spain, and Germany all show robust demand compared to 2019 over the rest of the summer. Compared to normal levels, UK demand to France remains poor for the next few weeks, with domestics taking up some of the slack.

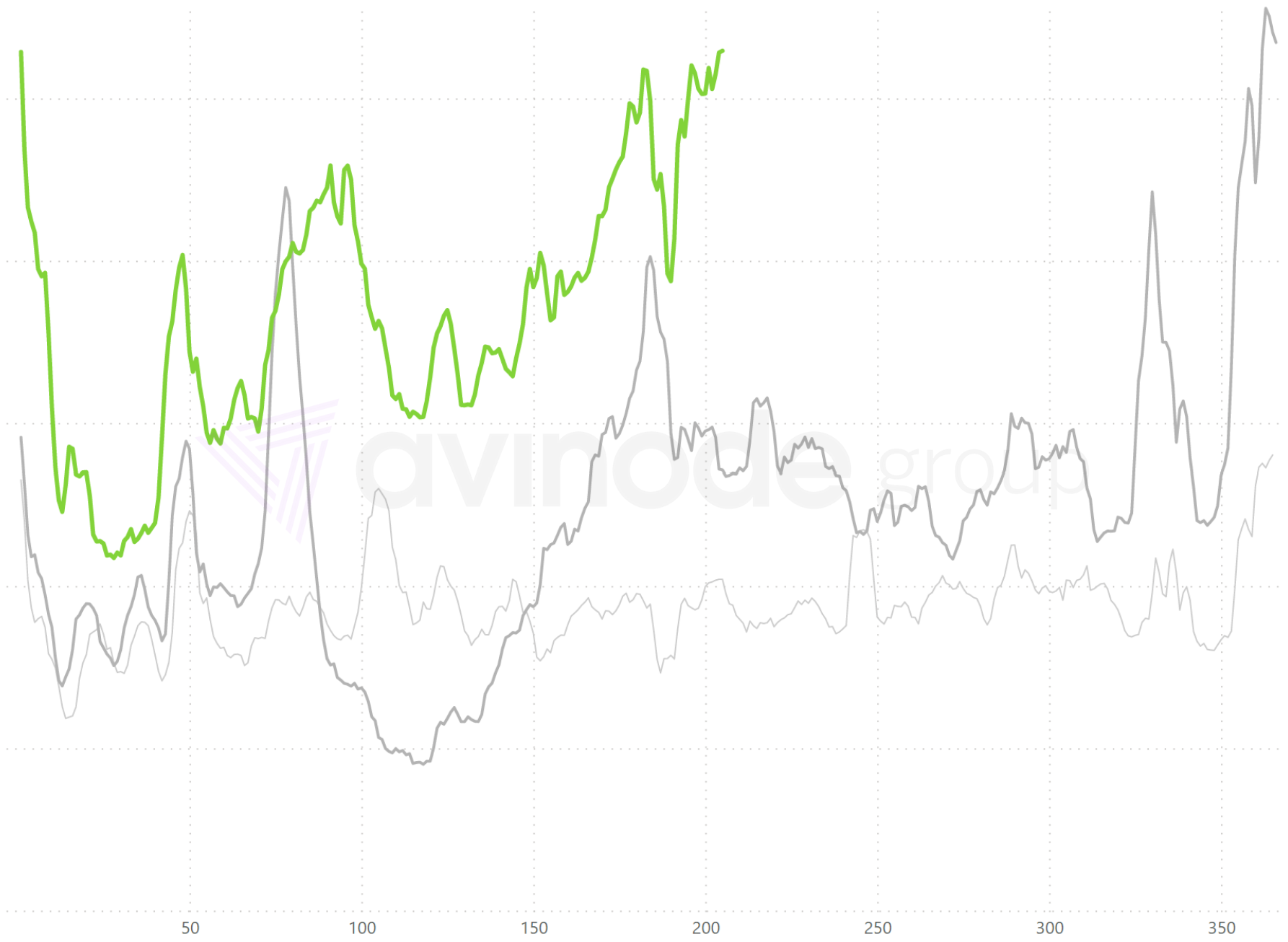

2020, Light grey = 2019). Day of year along the horizontal axis. Demand for

2021 is still growing.

In the US, demand for charter through Avinode continues to increase, albeit more slowly than a few weeks ago. When trips are being requested for has changed. The percentage of trips being requested within 4 days stands at 43% in July 2021 – compared to 34% in July 2019. These figures support the commentary that it is proving challenging to source charter to meet jet card demand in such a low supply environment.

It is the shortest duration trips that are recovering most strongly versus 2020, for example between Las Vegas and California. Last year the most popular charter routing was from the Southeast up to the Northeast, whereas this summer that pattern has reversed and demand is from the Northeast again. Of the major cities, demand from airports around New York City and Dallas is most notable compared to 2020, for the next 5 weeks. Travel to the Caribbean is led by Mexico, the Bahamas, and the Turks & Caicos.

Despite the threat of the spreading Delta variant that caused cases to rocket again in the UK, pent-up leisure demand has been released in Western markets. European demand is robust but still very seasonal. In the USA the boom is continuing and with business travel still to fully return, it looks like we could be witnessing a step-change in the size of the US market – further increasing its significance in our global industry.