Demand recovery – different places, different patterns

As presented in the last update, demand is slowly returning — at different rates, in different places and at different times. Although it's unevenly distributed, data from Avinode Marketplace suggests a positive trend in trip demand globally, with US domestic travel looking the most optimistic.

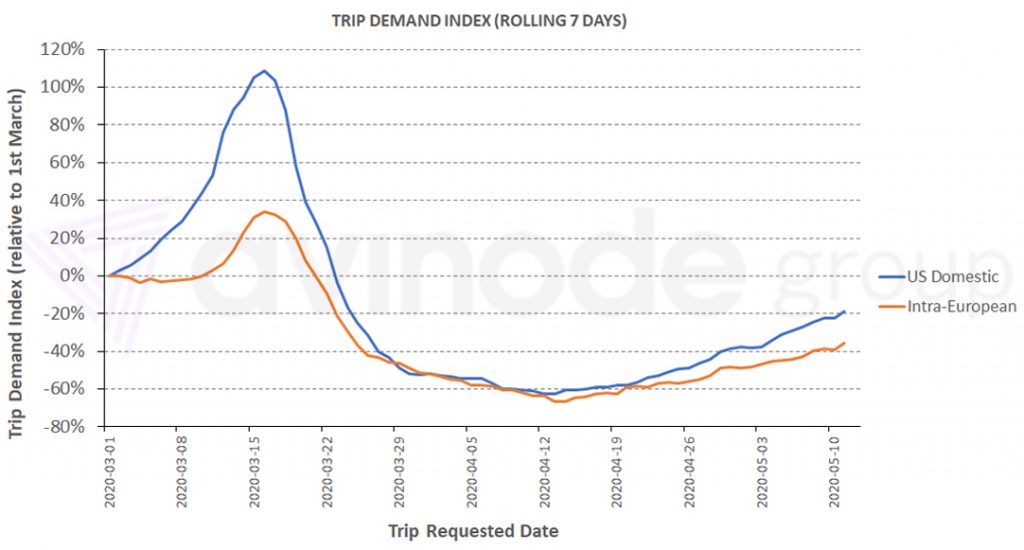

Demand index on the rise

The chart below is a rolling 7-day index of demand normalised to 1st March, for trips requested through the Avinode marketplace. Demand for US domestic (blue) and intra-European flights (red) has risen over the last week. Yesterday saw the most demand pass through Avinode for US domestic trips since the 17th March and for intra-European trips since 18th March. This is positive news.

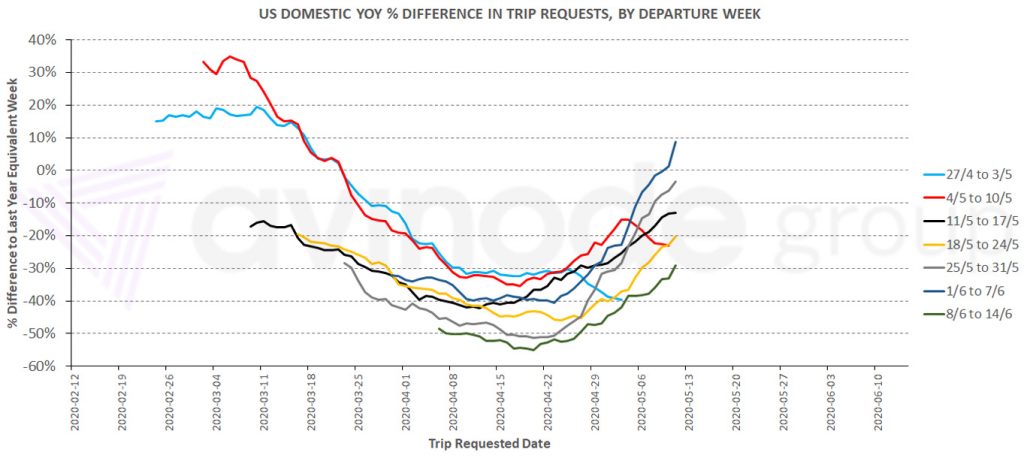

US domestic demand

The recovery stories for the different markets are very different. The chart below shows the % year-over-year difference in trips by requested date, aggregated up for each departure week for US domestic travel. It reveals that demand is quickly returning for travel throughout May and June – in fact, the first week of June has more trip requests at this stage than it did at the equivalent time last year. July is starting to recover its position too (not shown below).

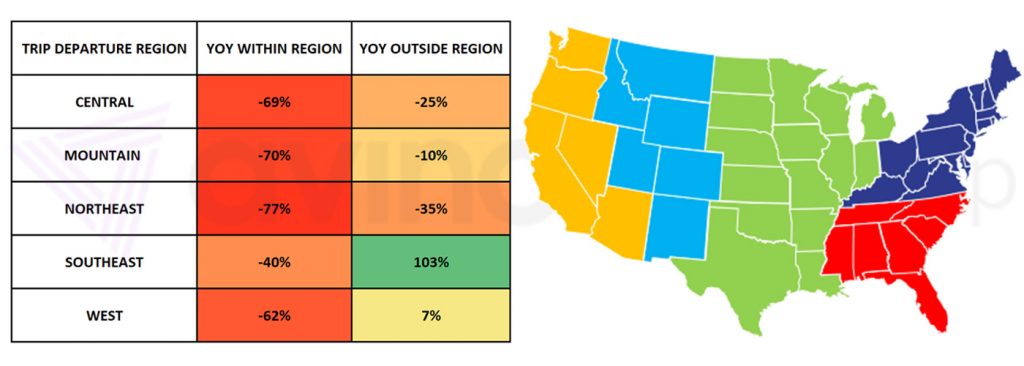

Unfortunately, the demand is not evenly distributed throughout the United States. The numbers for the period 18thMay to 14th June are dominated by demand for charter from the Southeast to the Northeast, Central and Mountain regions. We are starting to see demand return for the other direction too, southbound on the East Coast corridor, but it is not close to the level we see from the south. It is encouraging that figures for departure from the West Coast are improving too; for this market, travel to the Central and Mountain regions is doing best. Charter demand within regions remains depressed compared to the usual levels recorded in Avinode.

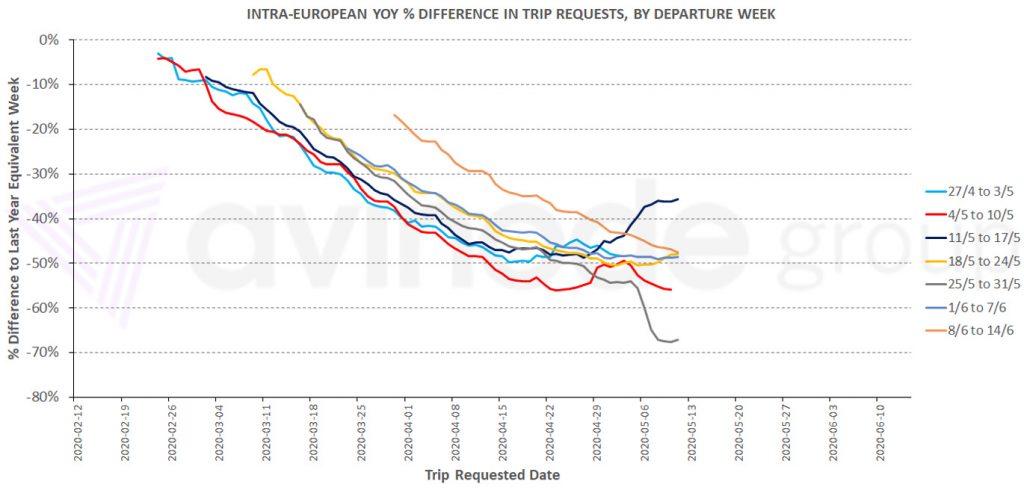

Europe shows slower rate

The picture in Europe is more complicated. As shown at the start of the article, charter demand is returning – the number of trips passing through Avinode yesterday was very encouraging – but at a slower rate than the US market. This is also a time of year when seasonality would normally be causing a big boost in European flights, meaning the European market has further to climb to get back to normal. Therefore year-over-year figures are still quite flat, even though charter demand is increasing every day. The chart below shows this aggregated by departure week. The big drop for the week of 25th to 31st May is caused by that week including the Champions League final last year and the confirmation in early May of which teams would compete in it; the drop does not reflect a big change in this year’s demand.

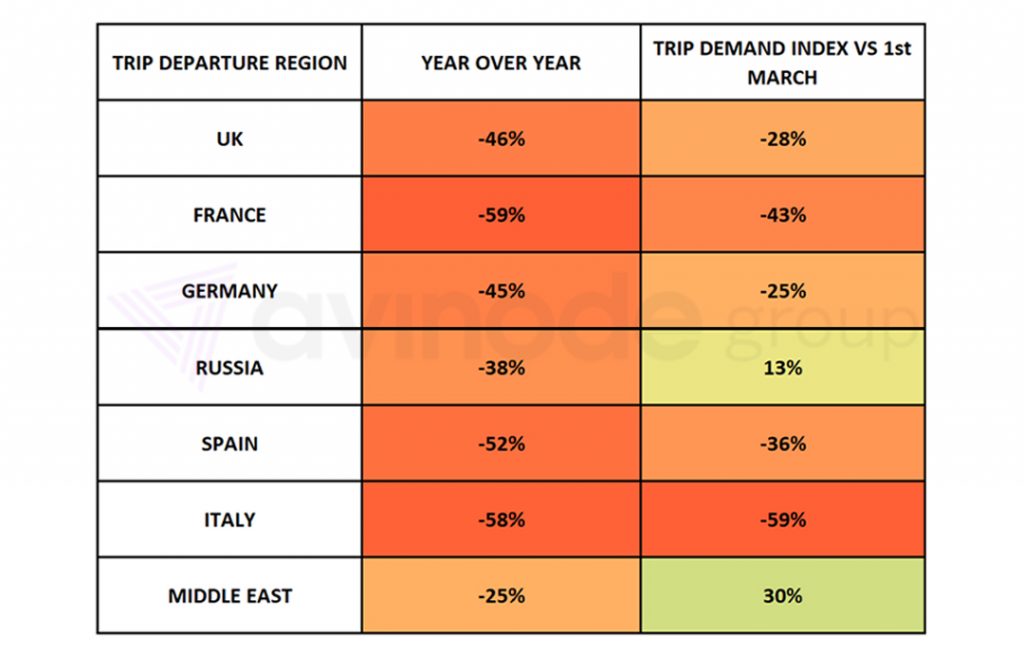

There are differences within the continent, as different countries come out of severe lockdowns at different times. Charter demand from the UK and Germany is more resilient for the upcoming weeks than France, Italy or Spain. In terms of arrival destinations, Portugal and Turkey are the most resilient larger markets. Russia and the Middle East are both faring better for charter demand; in addition, demand for travel from those areas has tended to come closer to departure in recent weeks. Within the Middle East, year-over-year charter demand from the UAE is up and from Saudi Arabia is down, for the period 18th May to 14th June.

“Demand is coming back, but at different rates in different places; the recovery stories of Europe and US have diverged.”

Demand is coming back, but at different rates in different places; the recovery stories of Europe and US have diverged. Whilst the low point of charter demand is behind us and it is encouraging that we are seeing more longer-term demand for the summer, normal demand patterns still appear to be a way off.

Harry Clarke,

Head of Insight, Avinode Group