Demand indicators are heading in the right direction

Demand is gradually returning. Increases across the US suggest that more normal demand patterns could be on the way in private charter’s biggest market, although post lockdown returns look like the main driver right now. Border relaxations and travel bubbles are key for a European recovery.

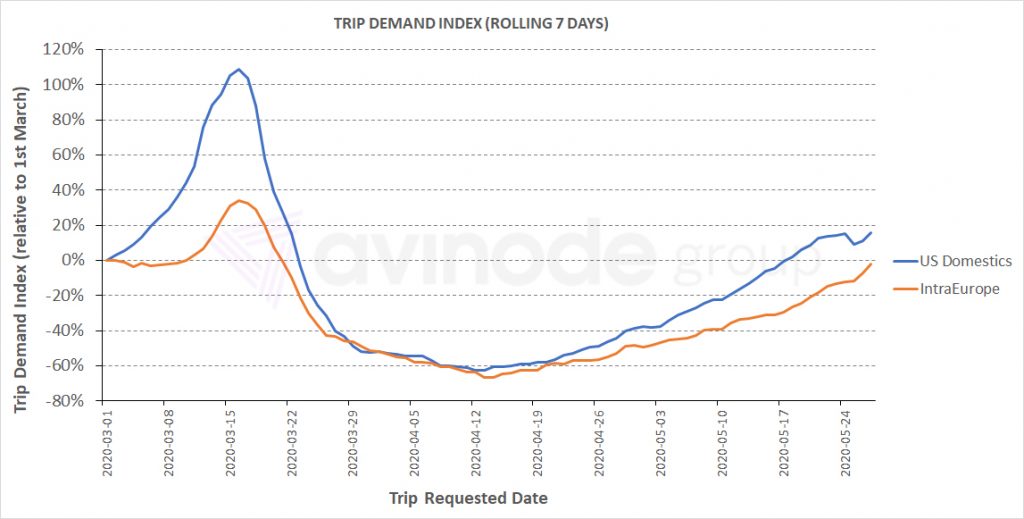

Trip demand index

The chart below is a rolling 7-day index of demand normalised to 1st March, for trips requested through the Avinode marketplace. Demand for US domestic (blue) and intra-European flights (red) has risen consistently in recent weeks – bar a drop off for Memorial Day in the US. We are now seeing more charter trips being requested through Avinode for US domestic trips than we were at the start of March and will very soon cross that boundary for intra-European trips too. It is unclear how much is from existing charter customers and how much is from those new to this form of travel.

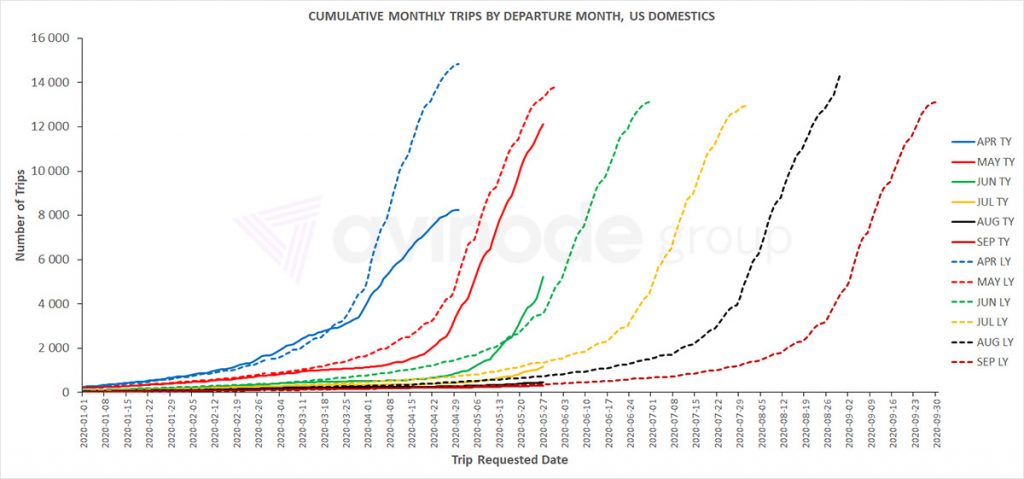

US domestic

The chart below shows the number of trips by requested date for each departure month, for US domestic travel. Demand for travel in May (red) has been much better as we moved away from April’s low, which finished 44% down year over year. Demand for travel in June (green) is higher at this point than it was at the equivalent stage last year, reflecting a surge in interest in private charter as stay-at-home orders ease. Early demand is coming back for July (orange) too.

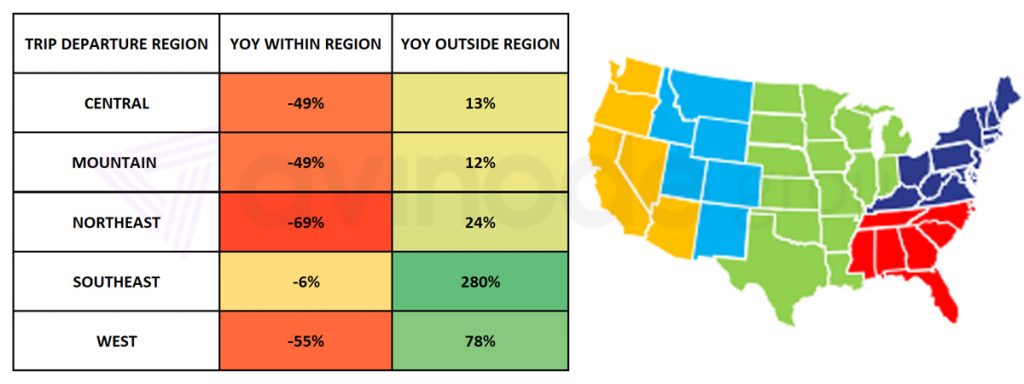

All markets in the US are seeing improvements compared to a couple of weeks ago and demand is no longer confined to travel from the Southeast. Interregional travel is performing much better than travel within regions – although those figures are slowly improving too. Demand for flights from the Southeast to other regions is up hugely in the first two weeks of June, probably due to those wanting to return to more northerly homes, whilst demand for other routings is spread out over the whole month. Demand to near international markets, such as the Bahamas and Mexico, is unsurprisingly down compared to June last year.

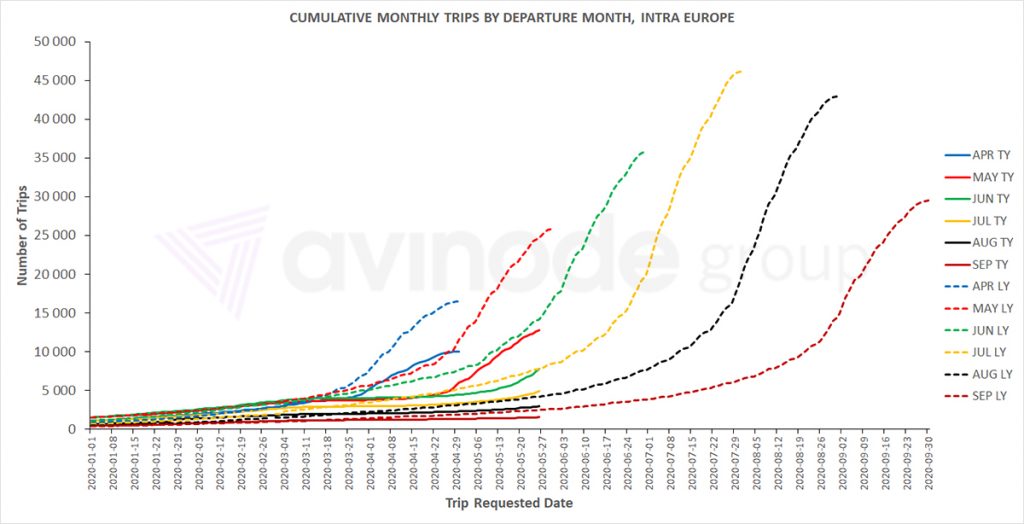

Intra-European demand

Demand in Europe is returning more gradually. Seasonality patterns mean the year-over-year figures are much lower than in the US, despite demand for intra-European travel in Avinode being close to its pre-COVID level. It is encouraging to see that demand for travel in June (green) and July (orange) is increasing, albeit still down 45% and 37% respectively, year over year. There are no early signs that summer demand is shifting later, to August (black) or September (dark red).

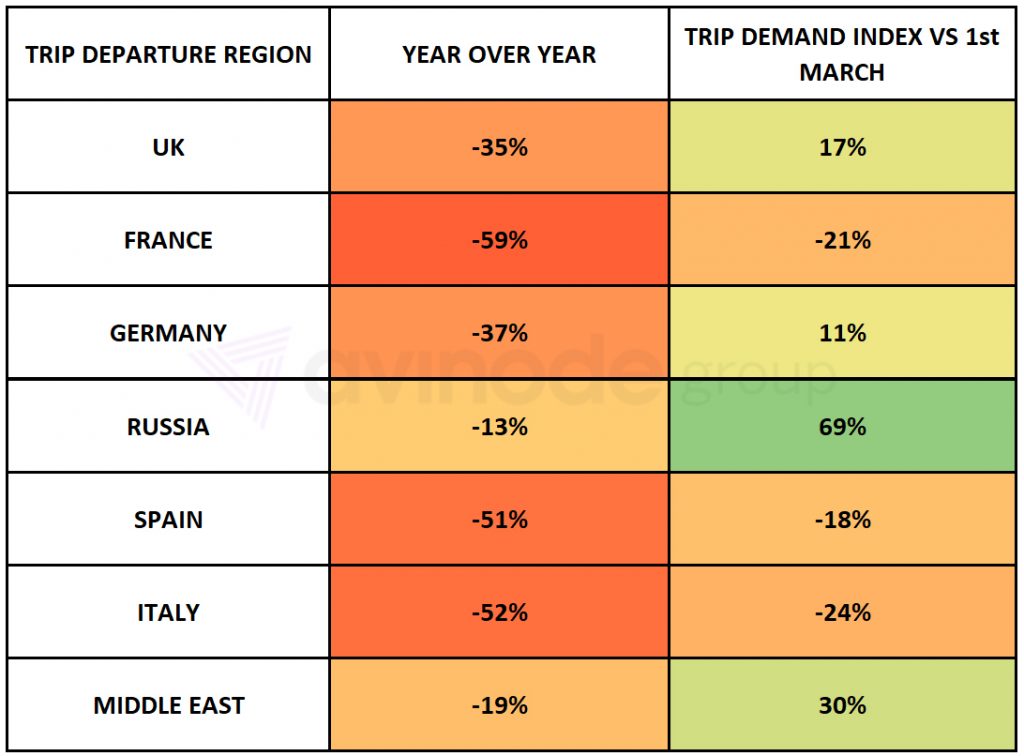

Changing travel restrictions result in differences within the continent. The UK is one of the more resilient major markets for future demand, despite a quarantine-on-return ruling from 8th June. As other border restrictions relax, more and more demand should be able to convert to flown movements. Looking forward to July, summer demand looks most promising from the Netherlands and Belgium. In terms of arrival destinations, Portugal is most resilient for travel from Western Europe, whilst in the next couple of weeks demand is spiking for travel from Russia to Cyprus and Montenegro.

Middle column shows year over year trip requests, by departure country, for departure 3rd – 28th June, relative to same stage of booking cycle. Right hand column shows rolling 7-day trip demand index for departure from each location, as of 27th May, index relative to 1st March. Middle East corresponds to ICAO region O. Only travel within Europe, Russia, Middle East & Morocco.

Harry Clarke,

Head of Insight, Avinode Group